Walgreens 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

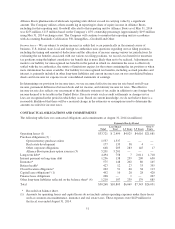

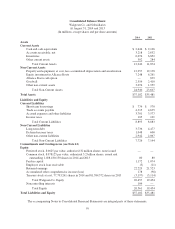

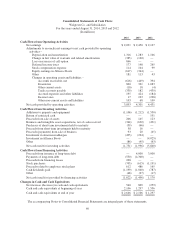

Consolidated Statements of Cash Flows

Walgreen Co. and Subsidiaries

For the years ended August 31, 2014, 2013 and 2012

(In millions)

2014 2013 2012

Cash Flows from Operating Activities

Net earnings $ 2,031 $ 2,450 $ 2,127

Adjustments to reconcile net earnings to net cash provided by operating

activities –

Depreciation and amortization 1,316 1,283 1,166

Change in fair value of warrants and related amortization (385) (120) —

Loss on exercise of call option 866 — —

Deferred income taxes 177 148 265

Stock compensation expense 114 104 99

Equity earnings in Alliance Boots (617) (344) —

Other 181 113 43

Changes in operating assets and liabilities –

Accounts receivable, net (616) (449) 394

Inventories 860 321 1,083

Other current assets (10) 18 (4)

Trade accounts payable (339) 182 (439)

Accrued expenses and other liabilities 195 424 (184)

Income taxes 17 103 (228)

Other non-current assets and liabilities 103 68 109

Net cash provided by operating activities 3,893 4,301 4,431

Cash Flows from Investing Activities

Additions to property and equipment (1,106) (1,212) (1,550)

Return of restricted cash — — 191

Proceeds from sale of assets 206 145 123

Business and intangible asset acquisitions, net of cash received (344) (630) (491)

Purchases of short term investments held to maturity (59) (66) —

Proceeds from short term investments held to maturity 58 16 —

Proceeds (payments) from sale of business 93 20 (45)

Investment in AmerisourceBergen (493) (224) —

Investment in Alliance Boots — — (4,025)

Other (86) (45) (63)

Net cash used for investing activities (1,731) (1,996) (5,860)

Cash Flows from Financing Activities

Proceeds from issuance of long-term debt — 4,000 3,000

Payments of long-term debt (550) (4,300) —

Proceeds from financing leases 268 — —

Stock purchases (705) (615) (1,191)

Proceeds related to employee stock plans 612 486 165

Cash dividends paid (1,199) (1,040) (787)

Other (48) (27) (17)

Net cash (used for) provided by financing activities (1,622) (1,496) 1,170

Changes in Cash and Cash Equivalents

Net increase (decrease) in cash and cash equivalents 540 809 (259)

Cash and cash equivalents at beginning of year 2,106 1,297 1,556

Cash and cash equivalents at end of year $ 2,646 $ 2,106 $ 1,297

The accompanying Notes to Consolidated Financial Statements are integral parts of these statements.

60