Walgreens 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amended on August 5, 2014, provides, subject to the satisfaction or waiver of specified conditions, a call option

that gives the Company the right, but not the obligation, to acquire the remaining 55% of Alliance Boots (second

step transaction) in exchange for an additional £3.1 billion in cash (approximately $5.2 billion using August 31,

2014 exchange rates) as well as an additional 144.3 million Company shares, subject to certain

adjustments. Pursuant to the amended Option Agreement, the Company exercised its option on August 5,

2014. In certain circumstances, if the second step transaction does not close, the Company’s ownership of

Alliance Boots will reduce from 45% to 42% in exchange for nominal consideration. The Company’s equity

earnings, initial investment and the call option exclude the Alliance Boots minority interest in Galenica Ltd.

(Galenica). The Alliance Boots investment in Galenica was distributed to the Alliance Boots shareholders other

than the Company in May 2013, which had no impact on the Company’s financial results.

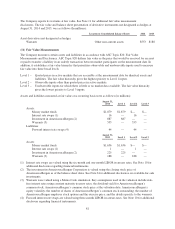

The call option, prior to its amendment and subsequent exercise, was valued using a Monte Carlo simulation

using assumptions surrounding Walgreens equity value as well as the potential impacts of certain provisions of

the Purchase and Option Agreement that are described in the Form 8-K filed by the Company on June 19, 2012.

The call option was accounted for at cost and subsequently adjusted for foreign currency translation gains or

losses. The final purchase price allocation resulted in $6.1 billion of the total consideration being allocated to the

investment and $866 million being allocated to the call option based on their relative fair values. The amendment

to the call option was accounted for as a non-monetary exchange with the amended call option valued as an out-

of-the-money option using a Monte Carlo simulation. The $866 million remeasurement loss was recorded in

other (expense)/income on the Consolidated Statements of Earnings.

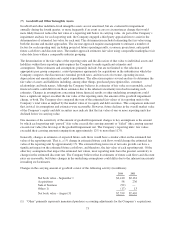

The Company accounts for its 45% investment in Alliance Boots using the equity method of

accounting. Investments accounted for under the equity method are recorded initially at cost and subsequently

adjusted for the Company’s share of the net income or loss and cash contributions and distributions to or from

these entities. Because the underlying net assets in Alliance Boots are denominated in a foreign currency,

translation gains or losses will impact the recorded value of the Company’s investment. The Company utilizes a

three-month lag in reporting equity income in Alliance Boots. Due to the lag and timing of the investment, only

10 months results of Alliance Boots were recorded in fiscal 2013 compared to 12 months of results recorded in

fiscal 2014. The Company’s investment is recorded as “Equity investment in Alliance Boots” in the Consolidated

Balance Sheets.

The Company’s initial investment in Alliance Boots exceeded its proportionate share of the net assets of Alliance

Boots by $2.4 billion. This premium of $2.4 billion is recognized as part of the carrying value in the Company’s

equity investment in Alliance Boots. The difference is primarily related to the fair value of Alliance Boots

indefinite-lived intangible assets and goodwill. The Company’s equity method income from the investment in

Alliance Boots is adjusted to reflect the amortization of fair value adjustments in certain definite-lived assets of

Alliance Boots. The Company’s incremental amortization expense associated with the Alliance Boots investment

was approximately $42 million in fiscal 2014. In fiscal 2013, the Company recognized approximately $57

million, including the inventory step-up, which was amortized over the first inventory turn.

During July 2013, the UK Government enacted a law to reduce the UK corporate tax rate effective April 2014

with a further reduction scheduled to take effect in April 2015. The non-cash impact of $71 million was recorded

in fiscal 2014 due to the three-month lag.

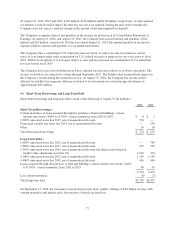

Other Equity Method Investments

Other equity method investments relate to joint ventures associated with the Company’s infusion and respiratory

business and its equity method investment received through the sale of the Take Care Employer business. These

investments are included within other non-current assets on the Consolidated Balance Sheets. The Company’s

share of equity income is reported within selling, general and administrative expenses in the Consolidated

Statements of Earnings.

71