Walgreens 2014 Annual Report Download - page 69

Download and view the complete annual report

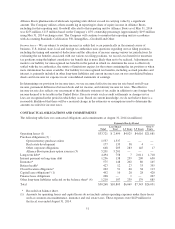

Please find page 69 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

(1) Summary of Major Accounting Policies

Description of Business

The Company is principally in the retail drugstore business and its operations are within one reportable

segment. At August 31, 2014, there were 8,309 drugstore and other locations in all 50 states, the District of

Columbia, Puerto Rico and U.S. Virgin Islands. Prescription sales were 64.2% of total sales for fiscal 2014

compared to 62.9% in 2013 and 63.2% in 2012.

Basis of Presentation

The consolidated financial statements include the accounts of the Company and its subsidiaries. All

intercompany transactions have been eliminated. The consolidated financial statements are prepared in

accordance with accounting principles generally accepted in the United States of America and include amounts

based on management’s prudent judgments and estimates. Actual results may differ from these estimates.

The Company’s 45% proportionate share of earnings in the Alliance Boots GmbH (Alliance Boots) equity

method investment is included in consolidated net earnings. The Company reports its share of equity earnings in

Alliance Boots within the operating section in the Consolidated Statements of Earnings because operations of

Alliance Boots are integral to Walgreens. The companies share common board of director members, recognize

purchasing synergies through Walgreens Boots Alliance Development GmbH, a 50/50 joint venture, as well as

engage in intercompany sales transactions on select front-end merchandise. Because of the three-month lag and

the timing of the closing of this investment, only the ten months of August through May’s results of operations

are reflected in the equity earnings in Alliance Boots included in the Company’s reported net earnings for year

ended August 31, 2013 compared to twelve months operating results for June through May in the current fiscal

year.

The Company directly owns a 50% interest in Walgreens Boots Alliance Development GmbH and indirectly

owns an additional ownership interest through its 45% ownership in Alliance Boots, representing a direct and

indirect economic interest of 72.5%. The financial results of the Walgreens Boots Alliance Development GmbH

joint venture are fully consolidated into the Company’s consolidated financial statements and reported without a

lag. As the joint venture is included within the Company’s operating results, Alliance Boots proportionate share

of Walgreens Boots Alliance Development GmbH earnings is removed from equity earnings and presented as a

component of noncontrolling interests.

Other Matters

Subsidiary Issuer Information

Walgreens Boots Alliance, Inc. (WBA) is a new corporation incorporated on September 2, 2014 under the

laws of Delaware and is currently a direct 100% owned finance subsidiary of the Company. Walgreens

Boots Alliance, Inc. is anticipated to be the issuer of one or more series of unsecured, unsubordinated notes

(WBA notes) in connection with the financing of a portion of the cash consideration payable in connection

with the second step transaction, the refinancing of substantially all of Alliance Boots’ total borrowings in

connection with the second step transaction and/or the payment of related fees and expenses. Following the

completion of the second step transaction, a portion of the net proceeds from the issuance of the WBA notes

may also be used for general corporate purposes, including the repayment and/or refinancing of existing

Company obligations. The Company will guarantee the WBA notes and such guarantee will be full and

unconditional.

The Company anticipates that neither the WBA notes nor any other potential Company or WBA financings

in connection with the second step transaction will contain any significant restrictions on the ability of the

Company’s subsidiaries to make dividend payments, loans or advances to the Company or WBA.

61