Walgreens 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

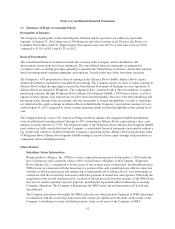

In addition, the Company is the issuer of five series of senior unsecured notes (Company Notes) and the

borrower under two revolving credit facilities (Company Credit Facilities). Neither the Company Notes nor

Company Credit Facilities are guaranteed by any of the Company’s subsidiaries. The Company Notes and

Company Credit Facilities do not contain any significant restrictions on the ability of the Company’s

subsidiaries to make dividend payments, loans or advances to the Company.

Other Information

In addition, this Amendment No. 1 on Form 10-K/A corrects the number of warrants to purchase shares of

AmerisourceBergen common stock issued to the Company and Alliance Boots GmbH in Note 10 to

11,348,456; the number of unvested stock options at August 31, 2014, in Note 14 to 18,896,912 and

typographical errors in Note 1 and Note 8.

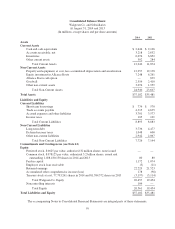

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and all highly liquid investments with an original maturity of

three months or less. Credit and debit card receivables from banks, which generally settle within two business

days, of $229 million and $160 million were included in cash and cash equivalents at August 31, 2014 and 2013,

respectively. At August 31, 2014 and 2013, the Company had $1.9 billion and $1.6 billion, respectively, in

money market funds, all of which was included in cash and cash equivalents.

The Company’s cash management policy provides for controlled disbursement. As a result, the Company had

outstanding checks in excess of funds on deposit at certain banks. These amounts, which were $267 million at

August 31, 2014, and $274 million at August 31, 2013, are included in trade accounts payable in the

accompanying Consolidated Balance Sheets.

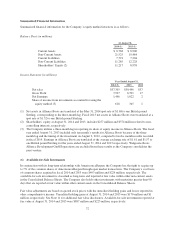

Allowance for Doubtful Accounts

The provision for bad debt is based on both historical write-off percentages and specifically identified

receivables. Activity in the allowance for doubtful accounts was as follows (in millions):

2014 2013 2012

Balance at beginning of year $154 $ 99 $ 101

Bad debt provision 86 124 107

Write-offs (67) (69) (109)

Balance at end of year $173 $154 $ 99

Inventories

Inventories are valued on a lower of last-in, first-out (LIFO) cost or market basis. At August 31, 2014 and 2013,

inventories would have been greater by $2.3 billion and $2.1 billion, respectively, if they had been valued on a

lower of first-in, first-out (FIFO) cost or market basis. As a result of declining inventory levels, the fiscal 2014,

2013 and 2012 LIFO provisions were reduced by LIFO liquidations of $187 million, $194 million and $268

million, respectively. Inventory includes product costs, inbound freight, warehousing costs and vendor

allowances not classified as a reduction of advertising expense.

Equity Method Investments

The Company uses the equity method to account for investments in companies if the investment provides the

ability to exercise significant influence, but not control, over operating and financial policies of the investee. The

Company’s proportionate share of the net income or loss of these companies is included in consolidated net

62