Walgreens 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(4) Acquisitions and Divestitures

In June 2014, the Company completed the sale of a majority interest in its subsidiary, Take Care Employer

Solutions, LLC (Take Care Employer) to Water Street Healthcare Partners (Water Street). At the same time,

Water Street made an investment in CHS Health Services (CHS), an unrelated entity and merged CHS with Take

Care Employer to create a leading worksite health company dedicated to improving the cost and quality of

employee health care. Water Street owns a majority interest in the new company while Walgreens owns a

significant minority interest and has representatives on the new company’s board of directors. The value of the

investment at August 31, 2014 was $67 million. The Company recognized an immaterial gain on the transaction.

In November 2013, the Company completed its acquisition of certain assets of Kerr Drug and its affiliates for

$173 million, subject to adjustment in certain circumstances. This acquisition included 76 retail locations as well

as a specialty pharmacy business and a distribution center. The preliminary purchase accounting for the Kerr

Drug acquisition added $45 million to goodwill and $54 million to intangible assets, primarily prescription files

and payer contracts, with $74 million allocated to net tangible assets. This allocation is subject to change as the

Company finalizes purchase accounting.

The aggregate purchase price of all business and intangible asset acquisitions, excluding Kerr Drug, was $171

million in fiscal 2014. These acquisitions added $13 million to goodwill and $119 million to intangible assets,

primarily prescription files. The remaining fair value relates to immaterial amounts of tangible assets, less

liabilities assumed. Operating results of businesses acquired have been included in the Consolidated Statements

of Earnings from their respective acquisition dates forward and were not material.

In fiscal 2013, the Company acquired Stephen L. LaFrance Holdings, Inc. (USA Drug) for $436 million net of

assumed cash. This acquisition increased the Company’s presence in the mid-South region of the country. The

purchase price allocation for this acquisition added $220 million to goodwill and $156 million to intangible

assets, primarily prescription files and non-compete agreements, with $60 million allocated to net tangible assets,

primarily inventory. The Company also acquired an 80% interest in Cystic Fibrosis Foundation Pharmacy LLC

for $29 million net of assumed cash and a call option to acquire the remaining 20% interest in 2015. The

investment provides joint ownership in a specialty pharmacy for cystic fibrosis patients and their families and a

provider of new product launch support and call center services for drug manufacturers. The investment added

$16 million to goodwill and $21 million to intangible assets, primarily payer contracts.

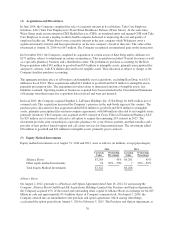

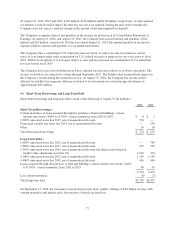

(5) Equity Method Investments

Equity method investments as of August 31, 2014 and 2013, were as follows (in millions, except percentages):

2014 2013

Carrying

Value

Ownership

Percentage

Carrying

Value

Ownership

Percentage

Alliance Boots $7,248 45% $6,261 45%

Other equity method investments 74 30% – 50% 7 30% – 50%

Total Equity Method Investments $7,322 $6,268

Alliance Boots

On August 2, 2012, pursuant to a Purchase and Option Agreement dated June 18, 2012, by and among the

Company, Alliance Boots GmbH and AB Acquisitions Holdings Limited (the Purchase and Option Agreement),

the Company acquired 45% of the issued and outstanding share capital of Alliance Boots in exchange for $4.025

billion in cash and approximately 83.4 million shares of Company common stock. On August 5, 2014, the

Company entered into an amendment to the purchase and option agreement, which among other things,

accelerated the option period from August 5, 2014 to February 5, 2015. The Purchase and Option Agreement, as

70