Walgreens 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

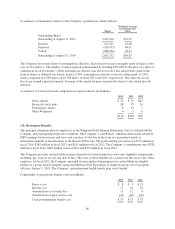

At August 31, 2014, 2013 and 2012, $105 million, $116 million and $118 million, respectively, of unrecognized

tax benefits would favorably impact the effective tax rate if recognized. During the next twelve months, the

Company does not expect a material change in the amount of the unrecognized tax benefits.

The Company recognizes interest and penalties in the income tax provision in its Consolidated Statements of

Earnings. At August 31, 2014, and August 31, 2013, the Company had accrued interest and penalties of $21

million and $28 million, respectively. For the year ended August 31, 2014, the amount reported in income tax

expense related to interest and penalties was an immaterial benefit.

The Company files a consolidated U.S. federal income tax return, as well as income tax returns in various

states. It is no longer under audit examination for U.S. federal income tax purposes for any years prior to fiscal

2012. With few exceptions, it is no longer subject to state and local income tax examinations by tax authorities

for years before fiscal 2007.

The Company has received tax holidays from Swiss cantonal income taxes relative to its Swiss operations. The

income tax holidays are expected to extend through September 2022. The holidays had an immaterial impact on

the Company’s results during the current fiscal year. At August 31, 2014, the Company has an unrecorded

deferred tax liability for temporary differences related to its investments in certain foreign subsidiaries of

approximately $85 million.

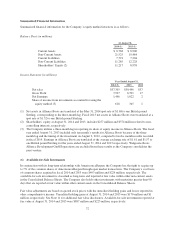

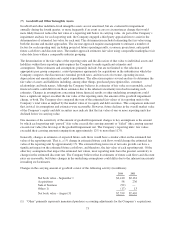

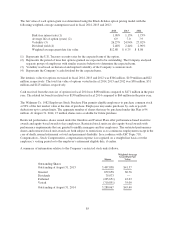

(9) Short-Term Borrowings and Long-Term Debt

Short-term borrowings and long-term debt consist of the following at August 31 (in millions):

2014 2013

Short-Term Borrowings –

Current maturities of loans assumed through the purchase of land and buildings; various

interest rates from 5.000% to 8.750%; various maturities from 2015 to 2035 $ 8 $ 2

1.000% unsecured notes due 2015, net of unamortized discount 750 —

Unsecured variable rate notes due 2014, net of unamortized discount — 550

Other 16 18

Total short-term borrowings $ 774 $ 570

Long-Term Debt –

1.000% unsecured notes due 2015, net of unamortized discount — 749

1.800% unsecured notes due 2017, net of unamortized discount 999 998

5.250% unsecured notes due 2019, net of unamortized discount and interest rate swap fair

market value adjustment (see Note 10) 1,010 994

3.100% unsecured notes due 2022, net of unamortized discount 1,199 1,199

4.400% unsecured notes due 2042, net of unamortized discount 496 496

Loans assumed through the purchase of land and buildings; various interest rates from 5.000%

to 8.750%; various maturities from 2015 to 2035 40 43

3,744 4,479

Less current maturities (8) (2)

Total long-term debt $3,736 $4,477

On September 13, 2012, the Company received net proceeds from a public offering of $4.0 billion of notes with

varying maturities and interest rates, the majority of which are fixed rate.

77