Walgreens 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

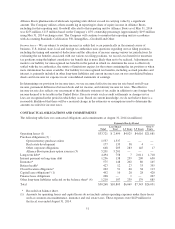

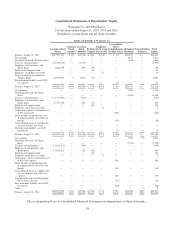

Consolidated Statements of Shareholders’ Equity

Walgreen Co. and Subsidiaries

For the years ended August 31, 2014, 2013 and 2012

(In millions, except shares and per share amounts)

Equity attributable to Walgreen Co.

Common Stock

Shares

Common

Stock

Amount

Treasury

Stock

Amount

Paid-In

Capital

Employee

Stock Loan

Receivable

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Noncontrolling

Interests

Total

Equity

Balance, August 31, 2011 889,294,130 $ 80 $(4,926) $ 834 $ (34) $ 16 $18,877 $— $14,847

Net earnings — — — — — — 2,127 — 2,127

Dividends declared ($.95 per share) — — — — — — (848) — (848)

Treasury stock purchases (34,720,215) — (1,191) — — — — — (1,191)

Employee stock purchase and

option plans 6,088,749 — 229 (75) — — — — 154

Stock-based compensation — — — 99 — — — — 99

Employee stock loan receivable — — — — 15 — — — 15

Shares issued for investment in

Alliance Boots 83,392,670 0 2,903 78 — — — — 2,981

Postretirement liability, net of $32

tax expense — — — — — 52 — — 52

Balance, August 31, 2012 944,055,334 $ 80 $(2,985) $ 936 $ (19) $ 68 $20,156 $— $18,236

Net earnings — — — — — — 2,450 — 2,450

Dividends declared ($1.14 per

share) — — — — — — (1,083) — (1,083)

Treasury stock purchases (13,797,490) — (615) — — — — — (615)

Employee stock purchase and

option plans 16,337,734 — 486 34 — — — — 520

Stock-based compensation — — — 104 — — — — 104

Employee stock loan receivable — — — — 8 — — — 8

Cumulative currency translation, net

of $55 tax benefit — — — — — (103) — — (103)

Share of other comprehensive loss

of Alliance Boots, net of $32 tax

benefit — — — — — (59) — — (59)

Unrecognized gain on available-for-

sale investments, net of tax — — — — — 1 — — 1

Postretirement liability, net of $3

tax benefit — — — — — (5) — — (5)

Balance, August 31, 2013 946,595,578 $ 80 $(3,114) $1,074 $ (11) $ (98) $21,523 $— $19,454

Net earnings — — — — — — 1,932 99 2,031

Dividends declared ($1.28 per

share) — — — — — — (1,226) — (1,226)

Treasury stock purchases (11,810,351) — (705) — — — — — (705)

Employee stock purchase and

option plans 15,601,662 — 622 (16) — — — — 606

Stock-based compensation — — — 114 — — — — 114

Employee stock loan receivable — — — — 6 — — — 6

Cumulative currency translation, net

of $154 tax expense — — — — — 286 — — 286

Share of other comprehensive loss

of Alliance Boots, net of $22 tax

benefit — — — — — (41) — — (41)

Unrecognized gain on available-for-

sale investments, net of $63 tax

expense — — — — — 106 — — 106

Unrealized loss on cash flow hedge,

net of $17 tax benefit — — — — — (27) — — (27)

Post retirement liability, net of $29

tax benefit — — — — — (48) — — (48)

Other — — — — — — — 5 5

Balance, August 31, 2014 950,386,889 $ 80 $(3,197) $1,172 $ (5) $ 178 $22,229 $104 $20,561

The accompanying Notes to Consolidated Financial Statements are integral parts of these statements.

58