Walgreens 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

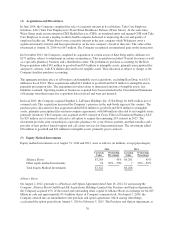

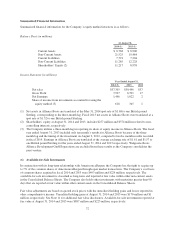

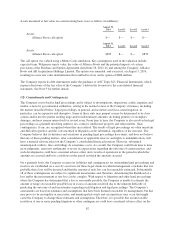

The deferred tax assets and liabilities included in the Consolidated Balance Sheets consist of the following (in

millions):

2014 2013

Deferred tax assets –

Postretirement benefits $ 247 $ 218

Compensation and benefits 166 136

Insurance 98 121

Accrued rent 166 157

Tax benefits 430 159

Stock compensation 131 159

Other 140 96

Subtotal 1,378 1,046

Less: Valuation allowance 223 19

Total deferred tax assets 1,155 1,027

Deferred tax liabilities –

Accelerated depreciation 1,244 1,369

Inventory 407 396

Intangible assets 64 53

Equity method investment 355 21

Deferred income 208 4

Subtotal 2,278 1,843

Net deferred tax liabilities $1,123 $ 816

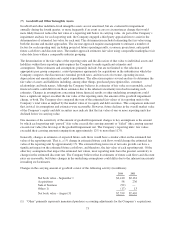

At August 31, 2014, the Company has recorded deferred tax assets of $430 million, primarily reflecting the benefit

of $1.0 billion in federal and $713 million in state ordinary and capital losses. These deferred tax assets will expire

at various dates from 2015 through 2033, with the majority of the federal losses expiring in 2019 and 2020.

The Company believes it is more likely than not that the benefit from certain net operating and capital loss

carryforwards will not be realized. In recognition of this risk, the Company has recorded a valuation allowance of

$223 million on certain deferred tax assets relating to these loss carryforwards as of August 31, 2014.

Income taxes paid were $1.2 billion for fiscal years 2014, 2013 and 2012.

ASC Topic 740, Income Taxes, provides guidance regarding the recognition, measurement, presentation and

disclosure in the financial statements of tax positions taken or expected to be taken on a tax return, including the

decision whether to file in a particular jurisdiction. As of August 31, 2014, all unrecognized tax benefits were

reported as long-term liabilities on the Consolidated Balance Sheet. As of August 31, 2013, $32 million of

unrecognized tax benefits were reported as current income tax liabilities, with the balance classified as long-term

liabilities on the Consolidated Balance Sheet.

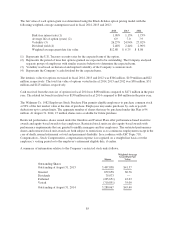

The following table provides a reconciliation of the total amounts of unrecognized tax benefits (in millions):

2014 2013 2012

Balance at beginning of year $208 $197 $ 94

Gross increases related to tax positions in a prior period 55 18 100

Gross decreases related to tax positions in a prior period (82) (32) (49)

Gross increases related to tax positions in the current period 46 30 53

Settlements with taxing authorities (22) (2) (1)

Lapse of statute of limitations (12) (3) —

Balance at end of year $193 $208 $197

76