Walgreens 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Walgreens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Alliance Boots pharmaceutical wholesale reporting units did not exceed its carrying value by a significant

amount. The Company utilizes a three-month lag in reporting its share of equity income in Alliance Boots,

including for this reporting unit. Goodwill allocated to this reporting unit by Alliance Boots as of May 31, 2014

was £255 million, £115 million based on the Company’s 45% ownership percentage (approximately $193 million

using May 31, 2014 exchange rates). The Company will continue to monitor this reporting unit in accordance

with Accounting Standards Codification 350, Intangibles—Goodwill and Other.

Income taxes – We are subject to routine income tax audits that occur periodically in the normal course of

business. U.S. federal, state, local and foreign tax authorities raise questions regarding our tax filing positions,

including the timing and amount of deductions and the allocation of income among various tax jurisdictions. In

evaluating the tax benefits associated with our various tax filing positions, we record a tax benefit for uncertain

tax positions using the highest cumulative tax benefit that is more likely than not to be realized. Adjustments are

made to our liability for unrecognized tax benefits in the period in which we determine the issue is effectively

settled with the tax authorities, the statute of limitations expires for the return containing the tax position or when

more information becomes available. Our liability for unrecognized tax benefits, including accrued penalties and

interest, is primarily included in other long-term liabilities and current income taxes on our consolidated balance

sheets and in income tax expense in our consolidated statements of earnings.

In determining our provision for income taxes, we use an annual effective income tax rate based on full-year

income, permanent differences between book and tax income, and statutory income tax rates. The effective

income tax rate also reflects our assessment of the ultimate outcome of tax audits in addition to any foreign-based

income deemed to be taxable in the United States. Discrete events such as audit settlements or changes in tax

laws are recognized in the period in which they occur. Based on current knowledge, we do not believe there is a

reasonable likelihood that there will be a material change in the estimates or assumptions used to determine the

amounts recorded for income taxes.

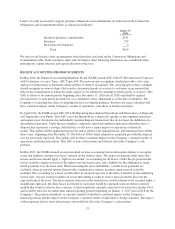

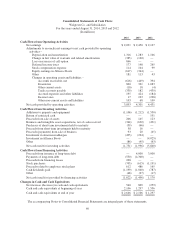

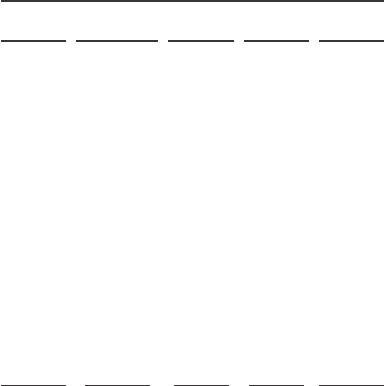

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

The following table lists our contractual obligations and commitments at August 31, 2014 (in millions):

Payments Due by Period

Total

Less Than 1

Year 1-3 Years 3-5 Years

Over 5

Years

Operating leases (1) $33,721 $ 2,499 $4,925 $4,616 $21,681

Purchase obligations (2) :

Open inventory purchase orders 1,537 1,537 — — —

Real estate development 177 135 38 4 —

Other corporate obligations 648 203 283 145 17

Alliance Boots purchase option exercise (3) 5,201 5,201 — — —

Long-term debt* 4,494 758 7 2,011 1,718

Interest payment on long-term debt 1,256 138 259 209 650

Insurance* 575 148 202 80 145

Retiree health* 427 12 27 33 355

Closed location obligations* 262 51 60 38 113

Capital lease obligations* (1) 492 16 28 28 420

Finance lease obligations 268 — 1 — 267

Other long-term liabilities reflected on the balance sheet* (4) 1,210 107 239 179 685

Total $50,268 $10,805 $6,069 $7,343 $26,051

* Recorded on balance sheet.

(1) Amounts for operating leases and capital leases do not include certain operating expenses under these leases

such as common area maintenance, insurance and real estate taxes. These expenses were $429 million for

the fiscal year ended August 31, 2014.

51