Tyson Foods 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

2001 RESULTS

It continued to be a difficult year for the chicken business. Energy and grain prices were up while ongoing oversupplies

in the industry kept chicken prices depressed. In addition, Tyson suffered setbacks related to weather, a product recall

and operational difficulties in Mexico early in the year.

Reported sales were $10.8 billion in 2001 compared to $7.4 billion in 2000. Reported diluted earnings per share were

$0.40 compared to $0.67 last year. Diluted earnings per share, excluding non-recurring items, were $0.47 compared

to $0.74 last year. This year’s results included nine weeks of IBP’s results in our fourth quarter. As we entered the

fourth quarter, we began to see higher prices in our chicken business. This was due to seasonal price increases,

improvement in industry fundamentals and improved pricing of our value-added products. Throughout the year, we

worked to build on our position as the low-cost producer by improving efficiencies in production, supply chain and

purchasing. We also worked hard to make a vast improvement in our internal supply and demand of chicken. This

was an important goal, and a significant accomplishment that has allowed us to continue shifting our product mix

to more highly value-added products with historically higher returns. To satisfy this growing demand, we made a

significant investment in our further-processing capabilities.

LOOKING AHEAD

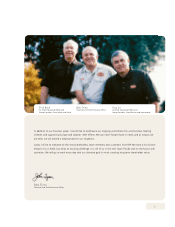

As we prepare to achieve the vision for the new company, we created an organizational structure based on our

relationships with our customers and focused on their needs. We are aligned in two channels – Food Service and

International headed by Co-Chief Operating Officer and Group President Greg Lee and Fresh Meats and Retail

headed by Co-Chief Operating Officer and Group President Dick Bond.

The new company’s management team identified three areas of potential synergies: consolidated purchasing,

integration of general and administrative functions into a shared services infrastructure and transportation and

logistics. We expect to achieve savings of $50 million in 2002 and $100 million by 2003. By fiscal 2004, we expect

to recognize annual savings in excess of $200 million.

Not only do we have the amazing presence of the Tyson brands, we now have a tremendous portfolio of additional

fresh, frozen and processed meat brands that can service all channels of distribution with all types of products.

We are evaluating how best to leverage these brands to complement the Tyson and Thomas E. Wilson brands both

regionally and nationally.

Acquiring IBP was certainly a strategic step for our future. Financially, we will continue our focus on improving our

return on invested capital while targeting average double digit EPS growth. In addition, we will be aggressive about

paying down debt. Our intention is to have debt as a percentage of capital at 50 percent or below by the end of

fiscal year 2004.