Tyson Foods 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

MANAGEMENT

’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2001 ANNUAL REPORT

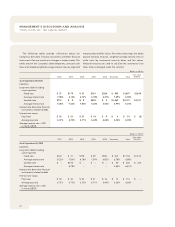

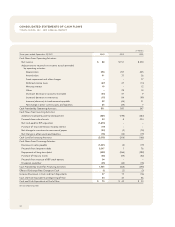

The following tables provide information about the

Company’s derivative financial instruments and other financial

instruments that are sensitive to changes in interest rates. The

tables present the Company’s debt obligations, principal cash

flows and related weighted average interest rates by expected

maturity dates and fair values. For interest rate swaps, the tables

present notional amounts, weighted average interest rates or

strike rates by contractual maturity dates and fair values.

Notional amounts are used to calculate the contractual cash

flows to be exchanged under the contract.

dollars in millions

Fair value

2002 2003 2004 2005 2006 Thereafter Total 9/29/01

As of September 29, 2001

Liabilities

Long-term debt including

current portion

Fixed rate

$ 27 $179 $ 31 $181 $284 $ 955 $1,657 $1,639

Average interest rate

7.08% 6.16% 6.73% 6.78% 6.47% 7.29% 6.96%

Variable rate

$715 $ 5 $ 8 $502 $ 2 $1,869 $3,101 $3,101

Average interest rate

4.06% 7.42% 7.53% 4.02% 6.56% 3.99% 4.03%

Interest rate derivative financial

instruments related to debt

Interest rate swaps

Pay fixed

$20 $21 $21 $16 $ 9 $ 4 $ 91 $ (6)

Average pay rate

6.72% 6.74% 6.71% 6.44% 6.62% 6.44% 6.65%

Average receive rate – USD

6 month LIBOR

dollars in millions

Fair value

2001 2002 2003 2004 2005 Thereafter Total 9/30/00

As of September 30, 2000

Liabilities

Long-term debt including

current portion

Fixed rate $123 $ 31 $178 $ 29 $180 $ 613 $1,154 $1,104

Average interest rate 8.23% 7.84% 6.18% 7.09% 6.80% 6.78% 6.88%

Variable rate $ – $276 $ – $ – $ – $ 50 $ 326 $ 326

Average interest rate – 6.78% – – – 5.64% 6.61%

Interest rate derivative financial

instruments related to debt

Interest rate swaps

Pay fixed $ 18 $ 20 $ 22 $ 21 $ 16 $ 13 $ 110 $ –

Average pay rate 6.72% 6.73% 6.73% 6.71% 6.44% 6.60% 6.66%

Average receive rate – USD

6 month LIBOR