Tyson Foods 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

MANAGEMENT

’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2001 ANNUAL REPORT

IBP ACQUISITION During the fourth quarter of fiscal 2001,

the Company acquired IBP, inc. (IBP). Headquartered in Dakota

Dunes, South Dakota, IBP is the world’s largest supplier of

premium fresh beef and pork products, with more than 60 pro-

duction sites in North America, joint venture operations in

China, Ireland and Russia and sales offices throughout the

world. IBP generated annual sales of approximately $17 billion

in 2000 and employs approximately 52,000 people.

In August 2001, the Company acquired 50.1% of IBP by paying

approximately $1.7 billion in cash. In September 2001, the Company

issued approximately 129 million shares of Class A stock, with a fair

value of approximately $1.2 billion, to acquire the remaining IBP

shares, and assumed approximately $1.7 billion of IBP debt. The

total acquisition cost of approximately $4.6 billion was accounted

for as a purchase in accordance with Statement of Financial

Accounting Standards (SFAS) No.141, “Business Combinations.”

Accordingly, the tangible and identifiable intangible assets and

liabilities have been adjusted to fair values with the remainder of

the purchase price recorded as goodwill. The allocation of the

purchase price has been completed.

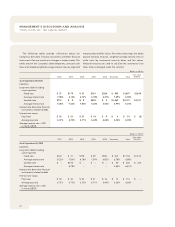

RESULTS OF OPERATIONS Earnings for fiscal 2001 were

$88 million or $0.40 per share compared to $151 million or $0.67

per share in fiscal 2000. The IBP results of operations for nine

weeks ending September 29, 2001, are included in the Company’s

consolidated results of operations, with the 49.9% of IBP that

was acquired on September 28, 2001, accounted for as minority

interest. This information should be considered when comparing

to previous years’ results of operations.

Earnings in fiscal 2001 were adversely affected by an over-

supply of chicken on the market for most of the year, causing an

adverse effect on the average sales prices and margins of many

of the Company’s core value-added products. In addition, costs

were adversely affected by weather conditions in the first half of

the year along with higher grain and energy costs. However,

fourth quarter earnings were favorably affected by improved

prices in the Chicken segment, improvement in industry funda-

mentals and inclusion of IBP’s operations for nine weeks.

The Company’s accounting cycle resulted in a 52-week year

for fiscal years 2001, 2000 and 1999. Additionally, the Company

adopted new accounting guidance related to shipping and

handling fees and costs (Emerging Issues Task Force 00-10). As

a result, certain costs were reclassified for fiscal years 2001, 2000

and 1999, from sales and selling expenses to cost of sales.

2001 vs. 2000

Sales increased 45.1%, with a 29.8% increase in volume and an

11.8% increase in price. The increase in sales is due primarily to

the inclusion of nine weeks of IBP’s sales in 2001. Comparable

sales increased 3.7% on a volume increase of 1.1% . Breast meat

commodity market prices were pressured by an oversupply of

chicken for much of the fiscal year causing an adverse effect on

the average sales prices and margins of many of the Company’s

core value-added products. During the fourth quarter of 2001,

the Company experienced improved pricing of value-added

products and seasonal price increases.

Cost of sales increased 49.7%, primarily due to the added cost

of sales for nine weeks of IBP’s operations. As a percent of sales,

cost of sales was 89.9% for 2001 compared to 87.1% for 2000.

Excluding IBP, comparable cost of sales as a percent of sales was

88.0%. The increase in comparable cost of sales, as a percent of

sales, was primarily due to weather-related effects combined

with higher grain and energy costs, lower market prices and

product mix changes.

Operating expenses increased 27.4%, primarily due to the

inclusion of nine weeks of IBP’s operations in 2001. As a percent

of sales, operating expenses were 7.2% for 2001 compared to

8.2% in 2000. Excluding IBP, comparable operating expenses as

a percent of sales were 8.8% for 2001. The increase is primarily

due to an increase in sales promotional expenses and litigation

costs related to the acquisition of IBP and ongoing employee

practice matters. Included in the 2000 operating expenses was

$24 million in bad debt reserve resulting from the bankruptcy

filing by AmeriServe Food Distribution, Inc. (AmeriServe).

Interest expense increased 24.9% compared to 2000. As a

percent of sales, interest expense was 1.3% compared to 1.6% for

2000. The Company’s average indebtedness increased by 24.3%

over the same period last year as a result of the IBP acquisition.

The Company’s short-term interest rates were slightly lower than

the same period last year, and the net average effective interest

rate on total debt was 6.9% for 2001 and 2000.

The effective tax rate decreased minimally to 35.4% compared

to 35.6% in 2000.