Tyson Foods 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

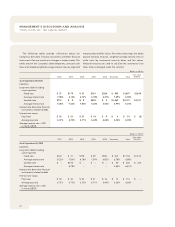

MANAGEMENT

’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2001 ANNUAL REPORT

In October 2001, the Company entered into a receivables

purchase agreement with three co-purchasers to sell up to

$750 million of trade receivables. The receivables purchase

agreement has an interest rate based on commercial paper

issued by the co-purchasers. Funds from the receivables

purchase agreement were used to repay $210 million and

$500 million outstanding under the $1 billion revolving

credit agreements.

MARKET RISK Market risks relating to the Company’s opera-

tions result primarily from changes in commodity prices, interest

rates and foreign exchange rates as well as credit risk concen-

trations. To address certain of these risks, the Company enters

into various hedging transactions as described below. If a deriv-

ative instrument is a hedge, depending on the nature of the

hedge, changes in the fair value of the instrument will either be

offset against the change in fair value of the hedged assets, liabil-

ities, or firm commitments through earnings, or recognized in

other comprehensive income (loss) until the hedged item is

recognized in earnings. The ineffective portion of an instrument’s

change in fair value will be immediately recognized in earnings.

Instruments that do not meet the criteria for hedge accounting

are marked to fair value with unrealized gains or losses reported

currently in earnings.

Commodities Risk The Company is a purchaser of certain

commodities, primarily corn and soybeans, and livestock. The

Company periodically uses commodity futures and options for

hedging purposes to reduce the effect of changing commodity

prices and as a mechanism to procure grains and livestock.

Generally, contract terms of a hedge instrument closely mirror

those of the hedged item providing a high degree of risk reduc-

tion and correlation. Contracts that are highly effective at meet-

ing this risk reduction and correlation criteria are recorded using

hedge accounting.

The Company held hedge positions in various grain futures,

primarily long positions, with net unrealized losses of $1 million

and $9 million at September 29, 2001, and September 30, 2000,

respectively. The Company also held hedge positions in livestock

futures, primarily short positions, with a fair value of $4 million at

September 29, 2001. Additionally, at September 29, 2001, the

Company held certain positions, primarily in livestock futures and

options, for which it does not apply hedge accounting, but instead

marks these positions to fair value through earnings at each

reporting date. The Company had reflected a fair value liability of

$11 million on its balance sheet at September 29, 2001, related to

these non-hedge positions.

Interest Rate and Foreign Currency Risks The Company

hedges exposure to changes in interest rates on certain of its

financial instruments. Under the terms of various leveraged

equipment loans, the Company enters into interest rate swap

agreements to effectively lock in a fixed interest rate for these

borrowings. The maturity dates of these leveraged equipment

loans range from 2005 to 2008 with interest rates ranging from

4.7% to 6.0%.

The Company also periodically enters into foreign exchange

forward contracts to hedge some of its foreign currency exposure.

The Company enters into forward contracts to hedge exposure to

United States currency fluctuations inherent in its receivables and

purchase commitments. These contracts had a notional amount

of $94 million and a net unrealized loss of $1 million recorded on

the balance sheet. Foreign forward contracts generally have matu-

rities or expirations not exceeding 12 months.