Tyson Foods 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

MANAGEMENT

’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2001 ANNUAL REPORT

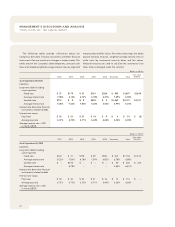

Concentrations of Credit Risk The Company’s financial instru-

ments that are exposed to concentrations of credit risk consist

primarily of cash equivalents and trade receivables. The Company’s

cash equivalents are in high quality securities placed with major

banks and financial institutions. Concentrations of credit risk

with respect to receivables are limited due to the large number

of customers and their dispersion across geographic areas. The

Company performs periodic credit evaluations of its customers’

financial condition and generally does not require collateral. No

single customer or customer group represents greater than 10%

of total accounts receivable.

RECENTLY ISSUED ACCOUNTING STANDARDS In May

2000, the Emerging Issues Task Force (EITF) reached a consensus

on Issue 00-14, “Accounting for Certain Sales Incentives

.”

This issue

involves the accounting and income statement classification for

sales subject to rebates and revenue sharing arrangements as well

as coupons and discounts. The EITF concluded that sales incen-

tives offered to customers to buy a product should be classified

as a reduction of sales. This issue is effective for fiscal quarters

beginning after December 15, 2001. The Company anticipates

implementing this issue in the first quarter of fiscal 2002.

In April 2001, the EITF released Issue 00-25, “Vendor Income

Statement Characterization of Consideration from a Vendor to a

Retailer,” which provides guidance on the classification of pay-

ments such as slotting fees and cooperative advertising in the

income statement. The EITF concluded that these payments are

a reduction of the selling prices of the vendor’s products and,

therefore, should be classified as a reduction of revenue in the

vendor’s income statement, instead of as an expense. This issue

is effective for fiscal quarters beginning after December 15, 2001.

The Company anticipates implementing this issue in the first quar-

ter of fiscal 2002.

In June 2001, the Financial Accounting Standards Board

(FASB) issued Statements of Financial Accounting Standards

No. 141, “Business Combinations” (SFAS 141), and No. 142,

“Goodwill and Other Intangible Assets” (SFAS 142). SFAS 141

eliminates the pooling-of-interests method of accounting for

business combinations and requires any business combination

completed after June 30, 2001, to be accounted for by the

purchase method. Additionally, SFAS141 changes the criteria to

recognize intangible assets apart from goodwill. Under SFAS 142,

goodwill and indefinite lived intangible assets are no longer

amortized but are reviewed annually, or more frequently if

impairment indicators arise, for impairment. Separable intan-

gible assets that have finite lives will continue to be amortized

over their useful lives. Because of the different transition dates

for goodwill and intangible assets acquired on or before June 30,

2001, and those acquired after that date, pre-existing goodwill

and intangibles will be amortized during this transition period

until adoption, whereas new goodwill and other indefinite

lived intangible assets acquired after June 30, 2001, are not

amortized. Companies are required to adopt SFAS 142 in their

fiscal year beginning after December 15, 2001. The Company

has applied SFAS 142 to the IBP transaction and anticipates

complete adoption of SFAS 142 for its 2002 fiscal year begin-

ning September 30, 2001. At that time goodwill will no longer

be amortized.

In October 2001, the FASB issued SFAS No. 144, “Accounting

for the Impairment or Disposal of Long-Lived Assets” (SFAS 144).

SFAS 144 supersedes SFAS No.121, “Accounting for the Impairment

of Long-Lived Assets and for Long-Lived Assets to Be Disposed

Of;” however, it retains the fundamental provisions of that

Statement related to the recognition and measurement of the

impairment of long-lived assets to be “held and used.” In addi-

tion, the Statement provides more guidance on estimating cash

flows when performing a recoverability test, requires that a

long-lived asset to be disposed of other than by sale (e.g., aban-

doned) be classified as “held and used” until it is disposed of,

and establishes more restrictive criteria to classify an asset as

“held for sale.” The Company is required to adopt SFAS 144 in

fiscal year 2003.