Tyson Foods 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

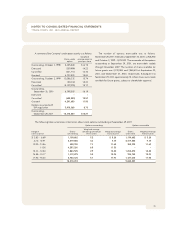

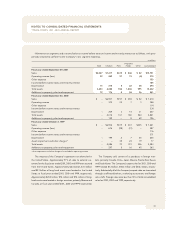

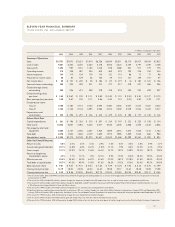

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2001 ANNUAL REPORT

v. Tyson, et al., C.A. No. 01-463 GMS; Meyers, et al. v. Tyson

Foods, Inc., et al., C.A. No. 01-489; Binsky v. Tyson Foods, Inc.,

et al., C.A. No. 01-495; Management Risk Trading LP v. Tyson

Foods, Inc., et al., C.A. No. 01-496; and Stark Investments, L.P.

et al. v. Tyson et al., C.A. No. 01-565 allege that the defendants

violated federal securities laws by making, or causing to be

made, false and misleading statements in connection with the

Company’s attempted termination of the Merger Agreement.

The plaintiffs allege that, as a result of the defendants’ alleged

conduct, the purported class members were harmed. The

defendants intend to vigorously defend these claims.

General Matters In July 1996, a lawsuit was filed against IBP by

certain cattle producers in the U.S. District Court, Middle District

of Alabama, seeking certification of a class of all cattle produc-

ers. The complaint alleges that IBP has used its market power

and alleged “captive supply” agreements to reduce the prices

paid to producers for cattle. Plaintiffs have disclosed that, in

addition to declaratory relief, they seek actual and punitive

damages. The original motion for class certification was denied

by the District Court; plaintiffs then amended their motion,

defining a narrower class consisting of only those cattle produc-

ers who sold cattle directly to IBP from 1994 through the date of

certification. The District Court approved this narrower class in

April 1999. The 11th Circuit Court of Appeals reversed the

District Court decision to certify a class, on the basis that there

were inherent conflicts amongst class members preventing the

named plaintiffs from providing adequate representation to the

class. The plaintiffs then filed pleadings seeking to certify an

amended class. The Court denied the plaintiffs’ motion on

October 17, 2000. Plaintiffs’ motion for reconsideration of the

judge’s decision was denied, and plaintiffs now seek to certify a

class of cattle producers who have sold exclusively to IBP on a

cash market basis. This motion, as well as the company’s

motions for summary judgment on both liability and damages,

is now pending. Management continues to believe that the

company has acted properly and lawfully in its dealings with

cattle producers.

On August 8, 2000, the Company was served with a com-

plaint filed in the U.S. District Court for the District of Arizona

styled Lemelson Medical, Education & Research Foundation,

Limited Partnership v. Alcon Laboratories, et al., CIV00-0661

PHX PGR. The plaintiff sued the Company, along with approxi-

mately 100 other defendants in the food, beverage, drug,

cosmetic and tobacco industries, claiming that the defendants

infringed various patents held by the Foundation. The alleged

patent infringement is based on the defendants’ use of the

Foundation’s automatic identification patents that relate to the

use of bar coding and/or the Foundation’s patents that relate to

machine vision. The Foundation seeks treble damages for the

defendants’ alleged infringement. The case is currently stayed

pending the resolution of related litigation.

The Company has been indicted in the Eastern District

of Tennessee for alleged violations of the Immigration and

Naturalization Act at several of the Company’s locations. The

Company will vigorously defend this matter and believes it has

meritorious defenses to the government’s theories of recovery;

however, the outcome of this matter and any potential liability

on the part of the Company cannot be determined at this time.

On October 17, 2000, a Washington County (Arkansas)

Chancery Court awarded the Company approximately $20 mil-

lion in its lawsuit alleging trade secret misappropriation by

ConAgra, Inc. and ConAgra Poultry Company. Subsequently,

on December 4, 2000, as a result of an opinion issued by the

Arkansas Supreme Court, the Chancery Court reversed its

finding that the Company’s nutrient profile was a trade secret

and reversed the jury’s $20 million verdict against the ConAgra

entities. On January 3, 2001, the Company filed a notice

of appeal appealing the Chancery Court’s reversal of the

trade secret determination and of the jury verdict. This appeal

is still pending.