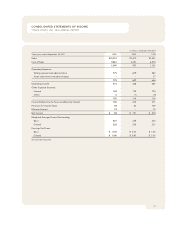

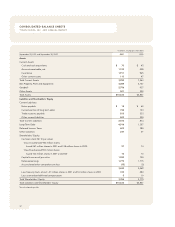

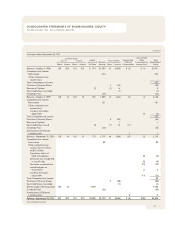

Tyson Foods 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

MANAGEMENT

’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2001 ANNUAL REPORT

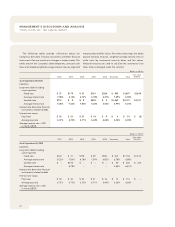

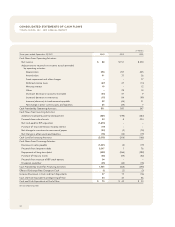

LIQUIDITY AND CAPITAL RESOURCES Cash provided

by operations continues to be the Company’s primary source of

funds to finance operating needs and capital expenditures. In

2001, net cash of $511 million was provided by operating

activities, a decrease of $76 million from 2000. The Company’s

foreseeable cash needs for operations and capital expenditures

are expected to continue to be met through cash flows provided

by operating activities. At September 29, 2001, the Company had

construction projects in progress that will require approximately

$182 million to complete.

CASH PROVIDED BY OPERATING ACTIVITIES

dollars in millions

Total debt at September 29, 2001, was $4.8 billion, an

increase of $3.3 billion from September 30, 2000, due primarily

to funding the IBP acquisition and assumption of IBP debt. The

Company has unsecured revolving credit agreements totaling

$1 billion that support the Company’s commercial paper program.

These $1 billion in facilities consist of $500 million that expires in

September 2002, and $500 million that expires in September

2006. At September 29, 2001, $210 million and $500 million

were outstanding under these facilities. Additional outstanding

debt at September 29, 2001, included $2.3 billion under a

Bridge Facility, $833 million of senior notes originally issued by

Tyson, $623 million of senior notes originally issued by IBP and

subsequently guaranteed by Tyson and other indebtedness of

$292 million.

TOTAL CAPITALIZATION

dollars in billions

Debt Equity

The revolving credit agreement and notes contain various

covenants, the more restrictive of which require maintenance

of a minimum net worth, current ratio, cash flow coverage of

interest and a maximum total debt-to-capitalization ratio. The

Company is in compliance with these covenants at fiscal year end.

In August 2001, the Company completed the financing for

the acquisition of IBP by entering into two bridge revolving

credit facilities consisting of a senior unsecured bridge credit

agreement which provided for aggregate borrowings up to

$2.5 billion (the Bridge Facility) and a senior unsecured receiv-

ables bridge credit agreement which provided for aggregate

borrowings up to $350 million (the Receivables Bridge Facility).

The Bridge Facility was to mature in January 2002, and the

Receivables Bridge Facility matured in November 2001. At

September 29, 2001, $2.3 billion was outstanding under the

Bridge Facility with an interest rate of 4.01%. There were no

borrowings under the Receivables Bridge Facility.

Subsequent to September 29, 2001, the Company refinanced

the Bridge Facility through the issuance of $2.25 billion of senior

notes sold in three tranches consisting of $500 million of 6.625%

notes due October 2004, $750 million of 7.25% notes due October

2006 and $1 billion of 8.25% notes due October 2011.

’01

’00

’99

511

547

587

’01

’00

’99

2.2

1.8

1.5

4.8

3.4

3.4

2.1