Tyson Foods 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

MANAGEMENT

’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2001 ANNUAL REPORT

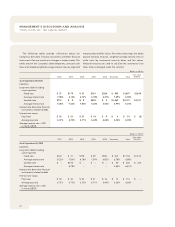

Segment Information

The IBP acquisition resulted in changes to reportable segments in

2001. The segments for 2000 and 1999 were restated to conform

with the 2001 presentation. The Company did not have a Beef

segment in periods prior to 2001.

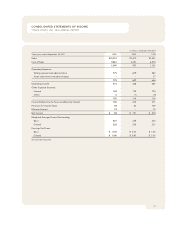

Sales by Segment

dollars in millions

2000 1999 Change

Chicken $6,907 $6,906 $ 1

Pork 157 109 48

Prepared Foods 294 301 (7)

Other 52 305 (253)

Total $7,410 $7,621 $(211)

Operating Income (Loss) by Segment

dollars in millions

2000 1999 Change

Chicken $315 $616 $(301)

Pork 23 (98) 121

Prepared Foods 7 (31) 38

Other 3 – 3

Total $348 $487 $(139)

Chicken segment sales increased slightly compared to 1999 with

a 0.4% increase in volume offset by a 0.3% decrease in average

sales prices. Foodservice channel sales decreased $34 million or

1.0%, retail channel sales remained level and international sales

including Tyson de Mexico decreased $5 million or 0.7% com-

pared to 1999. The offsetting increase in sales resulted primarily

from the Company’s chicken breeding stock subsidiary and

the Company’s allied products. Operating income for Chicken

decreased $301 million or $48.9% from 1999 primarily due to

lower market prices, higher grain costs and changes in product

mix. In addition, the Company’s Mexican subsidiary suffered

losses from the outbreak of Exotic Newcastle disease and result-

ing decreases in production, and the Chicken segment had a

$24 million bad debt writeoff related to the January 2000

bankruptcy filing by AmeriServe.

Pork segment sales increased $48 million or 43.6% over 1999,

with a 56.5% increase in average sales prices partially offset by

an 8.3% decrease in volume. Pork segment operating income

improved $121 million or 123.1% over 1999 primarily due to the

increase in average sales prices and the write-down of pork

assets at the end of 1999 due to the anticipated sale of the

pork business. The Company’s Pork segment includes feeder pig

finishing and marketing of swine to regional and national packers.

Prepared Foods segment sales totaled $294 million compared

to $301 million for 1999. The Prepared Foods segment operating

income increased $38 million from 1999. The increase in operat-

ing income is primarily due to the 1999 impairment charge of

$23 million related to the write-down of Mallard’s Food Products’

property and equipment and goodwill. Also, in 1999, the Prepared

Foods segment experienced losses related to product recalls.

Other segment sales decreased $253 million or 83.2% from

1999 primarily due to the sale of the seafood and other non-

core businesses during fiscal 1999.