Tyson Foods 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2001 ANNUAL REPORT

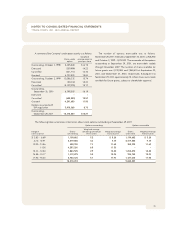

The majority of the Company’s operations are domiciled in

the United States. Approximately 97% of sales to external cus-

tomers for the fiscal years ended 2001, 2000 and 1999 were sourced

from the United States. Approximately $6.6 billion, $3.0 billion

and $3.1 billion of long-lived assets were located in the United

States at fiscal years ended 2001, 2000 and 1999, respectively.

Approximately $204 million, $74 million and $74 million of long-

lived assets were located in foreign countries, primarily Mexico and

Canada, at fiscal years ended 2001, 2000 and 1999, respectively.

The Company sells certain of its products in foreign mar-

kets, primarily Canada, China, Japan, Mexico, Puerto Rico, Russia

and South Korea. The Company’s export sales for 2001, 2000 and

1999 totaled $1.2 billion, $550 million and $546 million, respec-

tively. Substantially all of the Company’s export sales are transacted

through unaffiliated brokers, marketing associations and foreign

sales staffs. Foreign sales were less than 10% of total consolidated

sales for 2001, 2000 and 1999, respectively.

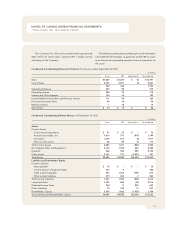

Information on segments and a reconciliation to income before taxes on income and minority interest are as follows, with prior

periods restated to conform to the Company’s new segment reporting:

in millions

Prepared

Beef Chicken Pork Foods Other Consolidated

Fiscal year ended September 29, 2001

Sales

$2,027 $7,217 $619 $ 846 $ 42 $10,751

Operating income (loss)

32 249 27 15 (8) 315

Other expense

150

Income before income taxes and minority interest

165

Depreciation

15 214 5 22 38 294

Total assets

3,203 4,084 944 1,406 995 10,632

Additions to property, plant and equipment

19 176 4 26 36 261

Fiscal year ended September 30, 2000

Sales $ – $6,907 $157 $ 294 $ 52 $ 7,410

Operating income – 315 23 7 3 348

Other expense 114

Income before income taxes and minority interest 234

Depreciation – 209 3 14 31 257

Total assets – 4,016 101 180 544 4,841

Additions to property, plant and equipment – 139 – 8 49 196

Fiscal year ended October 2, 1999

Sales $ – $6,906 $109 $ 301 $305 $ 7,621

Operating income (loss) – 616 (98) (31) – 487

Other expense 116

Income before income taxes and minority interest 371

Depreciation – 199 4 7 45 255

Asset impairment and other charges* – – 35 23 19 77

Total assets – 4,286 70 191 536 5,083

Additions to property, plant and equipment – 297 5 16 45 363

*Asset impairment and other charges also included in operating income