Tyson Foods 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

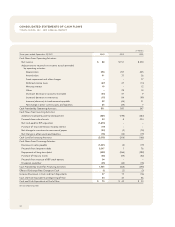

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2001 ANNUAL REPORT

Depreciation: Depreciation is provided primarily by the straight-

line method using estimated lives for buildings and leasehold

improvements of 10 to 39 years, machinery and equipment of

three to 12 years and other of three to 20 years.

Impairment: The Company reviews the carrying value of long-

lived assets at each balance sheet date if indication of impair-

ment exists. Recoverability is assessed using undiscounted cash

flows based upon historical results and current projections of

earnings before interest and taxes. The Company measures

impairment using discounted cash flows of future operating

results based upon a rate that corresponds to the Company’s

cost of capital. Impairments are recognized in operating results

to the extent that carrying value exceeds discounted cash flows

of future operations.

Goodwill: Statement of Financial Accounting Standards (SFAS)

No. 141, “Business Combinations” and SFAS No. 142, “Goodwill

and Other Intangible Assets” have been applied to the IBP

transaction. Accordingly, the tangible and identifiable intangible

assets and liabilities have been adjusted to fair values with

the remainder of the purchase price recorded as goodwill.

Additionally, goodwill and indefinite lived intangible assets are

not amortized but are reviewed for impairment at least annually

or more frequently if impairment indicators arise. Goodwill of

$926 million, net of accumulated amortization, arising prior to

the IBP transaction has been amortized on a straight-line basis

over periods ranging from 15 to 40 years. Upon complete adop-

tion of SFAS 142, in the first quarter of 2002, this goodwill will

no longer be amortized. At September 29, 2001, and September

30, 2000, the accumulated amortization of goodwill was $286

and $256 million, respectively.

Amount of goodwill by segment at September 29, 2001:

in millions

Beef

$1,306

Chicken

916

Pork

350

Prepared Foods

184

Total

$2,756

Goodwill has been allocated to reporting units based on fair

value of identifiable assets. Approximately $29 million of this

goodwill is deductible for income tax purposes.

Capital Stock: Holders of Class B common stock (Class B stock)

may convert such stock into Class A common stock (Class A

stock) on a share-for-share basis. Holders of Class B stock are

entitled to 10 votes per share while holders of Class A stock

are entitled to one vote per share on matters submitted to share-

holders for approval. Cash dividends cannot be paid to holders of

Class B stock unless they are simultaneously paid to holders

of Class A stock. The per share amount of the cash dividend paid

to holders of Class B stock cannot exceed 90% of the cash divi-

dend simultaneously paid to holders of Class A stock. The

Company pays quarterly cash dividends to Class A and Class B

shareholders. The Company paid Class A dividends per share of

$0.16, $0.16 and $0.115 and Class B dividends per share of $0.144,

$0.144 and $0.104 in 2001, 2000 and 1999, respectively.

Stock-Based Compensation: Stock-based compensation is

recognized using the intrinsic value method. For disclosure

purposes, pro forma net income and earnings per share impacts

are provided as if the fair value method had been applied.

Financial Instruments: Periodically, the Company uses deriva-

tive financial instruments to reduce its exposure to various

market risks. The Company does not regularly engage in spec-

ulative transactions, nor does the Company regularly hold or

issue financial instruments for trading purposes. However, the

Company does periodically hold positions as economic hedges

for which hedge accounting is not applied. Generally, contract

terms of a hedge instrument closely mirror those of the hedged

item providing a high degree of risk reduction and correlation.

Contracts that are highly effective at meeting the risk reduction

and correlation criteria are recorded using hedge accounting. If

a derivative instrument is a hedge, depending on the nature of

the hedge, changes in the fair value of the instrument will either

be offset against the change in fair value of the hedged assets,

liabilities, or firm commitments through earnings or recognized

in other comprehensive income until the hedged item is recog-

nized in earnings. The ineffective portion of an instrument’s

change in fair value will be immediately recognized in earnings.

Instruments that do not meet the criteria for hedge accounting

are marked to fair value with unrealized gains or losses reported

currently in earnings. The Company generally does not hedge

anticipated transactions beyond 12 months.