Tyson Foods 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2001 ANNUAL REPORT

The weighted average fair value of options granted during

2001 was approximately $4.24. The fair value of each option

grant is established on the date of grant using the Black-Scholes

option-pricing model. Assumptions include an expected life of

six years, risk-free interest rate of 4.8%, expected volatility of

35.2% and dividend yield of 1.4% in 2001.

The Company applies Accounting Principles Board Opinion

No. 25 and related interpretations in accounting for its employee

stock option plans. Accordingly, no compensation expense was

recognized for its stock option plans. Had compensation cost for

the employee stock option plans been determined based on the

fair value method of accounting for the Company’s stock option

plans, the tax-effected impact would be as follows:

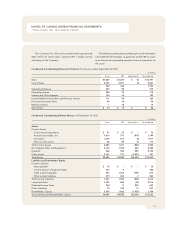

in millions, except per share data

2001

2000 1999

Net Income

As reported

$88

$ 151 $ 230

Pro forma

85

148 226

Earnings per share

As reported

Basic

0.40

0.67 1.00

Diluted

0.40

0.67 1.00

Pro forma

Basic

0.38

0.66 0.98

Diluted

0.38

0.65 0.98

Pro forma net income reflects only options granted after

fiscal 1995. Additionally, the pro forma disclosures are not likely

to be representative of the effects on reported net income for

future years.

NOTE 12: BENEFIT PLANS

The Company has defined contribution retirement and incentive

benefit programs for various groups of Company personnel.

Company contributions totaled $35 million, $32 million and

$33 million in 2001, 2000 and 1999, respectively.

NOTE 13: TRANSACTIONS

WITH RELATED PARTIES

The Company has operating leases for farms, equipment and

other facilities with the former Senior Chairman of the Board of

Directors of the Company and certain members of his family, as

well as a trust controlled by him, for rentals of $9 million in 2001,

$7 million in 2000 and $7 million in 1999. Other facilities have

been leased from other officers and directors for rentals totaling

$2 million in 2001, $3 million in 2000 and $3 million in 1999.

Certain officers and directors are engaged in chicken and

swine growout operations with the Company whereby these

individuals purchase animals, feed, housing and other items to

raise the animals to market weight. The total value of these

transactions amounted to $10 million in 2001, $11 million in 2000

and $10 million in 1999.

Certain unimproved real property was sold by the Company

in June 2000 to an entity controlled by the daughter and

son-in-law of the former Senior Chairman of the Board for approx-

imately $5 million. The purchase price was in excess of the market

value as determined by a current independent appraisal.

NOTE 14: INCOME TAXES

Detail of the provision for income taxes consists of:

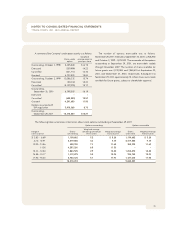

in millions

2001

2000 1999

Federal

$50

$73 $113

State

5

58

Foreign

3

58

$58

$83 $129

Current

$105

$36 $142

Deferred

(47)

47 (13)

$58

$83 $129