Tyson Foods 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2001 ANNUAL REPORT

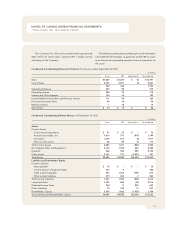

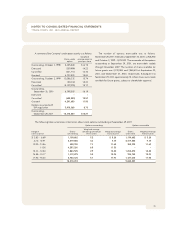

NOTE 10: LONG-TERM DEBT

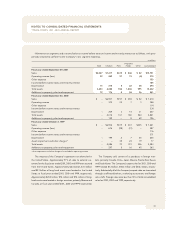

The Company has unsecured revolving credit agreements total-

ing $1 billion that support the Company’s commercial paper

program. These facilities consist of $500 million that expires in

September 2002 and $500 million that expires in September

2006. At September 29, 2001, the borrowings under these facil-

ities totaled $210 million and $500 million, respectively.

In August 2001, the Company completed the financing for

the acquisition of IBP by entering into two bridge revolving credit

facilities consisting of a senior unsecured bridge credit agree-

ment which provided for aggregate borrowings up to $2.5 billion

(the Bridge Facility) and a senior unsecured receivables bridge

credit agreement which provided for aggregate borrowings up

to $350 million (the Receivables Bridge Facility). The Bridge Facility

was to mature in January 2002, and the Receivables Bridge

Facility matured in November 2001. At September 29, 2001,

$2.3 billion was outstanding under the Bridge Facility with an

interest rate of 4.01%. There were no borrowings under the

Receivables Bridge Facility.

Subsequent to September 29, 2001, the Company refinanced

the Bridge Facility through the issuance of $2.25 billion of senior

notes. The senior notes were sold in three tranches consisting of

$500 million of 6.625% notes due October 2004, $750 million of

7.25% notes due October 2006 and $1 billion of 8.25% notes

due October 2011.

In October 2001, the Company entered into a receivables

purchase agreement with three co-purchasers to sell up to

$750 million of trade receivables. The receivables purchase

agreement has been accounted for as a borrowing. The receiv-

ables purchase agreement has an interest rate based on

commercial paper issued by the co-purchasers. Funds from the

receivables purchase agreement were used to repay $210 mil-

lion and $500 million outstanding under the $1 billion revolving

credit agreements.

At September 29, 2001, the Company had outstanding

letters of credit totaling approximately $124 million issued pri-

marily in support of workers’ compensation insurance programs,

industrial revenue bonds and the leveraged equipment loans.

There were no draw downs under these letters of credit at

September 29, 2001.

Under the terms of the leveraged equipment loans, the

Company had restricted cash totaling approximately $50 million,

which is included in other assets at September 29, 2001. Under

these leveraged loan agreements, the Company entered into

interest rate swap agreements to effectively lock in a fixed inter-

est rate for these borrowings.

Annual maturities of long-term debt for the five years sub-

sequent to September 29, 2001, are: 2002 – $742 million;

2003 – $184 million; 2004 – $39 million; 2005 – $683 million and

2006 – $286 million.

The revolving credit agreement and notes contain various

covenants, the more restrictive of which require maintenance

of a minimum net worth, current ratio, cash flow coverage of

interest and fixed charges and a maximum total debt-to-

capitalization ratio. The Company is in compliance with these

covenants at fiscal year end.

Industrial revenue bonds are secured by facilities with a net

book value of $86 million at September 29, 2001. The weighted

average interest rate on all outstanding short-term borrowing was

5.1% at September 29, 2001, and 6.8% at September 30, 2000.

Long-term debt consists of the following:

in millions

Maturity

2001

2000

Commercial paper (4.01%

effective rate at 9/29/01) 2002

$ 210

$ 260

Revolver (4.05% effective

rate at 9/29/01) 2006

500

–

Bridge Facility (4.01%

effective rate at 9/29/01) 2002

2,300

–

Debt securities issued by

Tyson (rates ranging

from 6% to 7%) 2001– 2028

833

880

Senior notes issued by IBP,

guaranteed by Tyson

(rates ranging from

6.125% to 7.95%) 2006 – 2026

623

–

Institutional notes (rates

ranging from 10.61%

to 11.375%) 2001– 2006

50

111

Leveraged equipment

loans (rates ranging

from 4.7% to 6.0%) 2005 – 2008

138

155

Other Various

104

74

Total debt

$4,758

$1,480

Less current maturities

742

123

Total long-term debt

$4,016

$1,357

Additionally, the Company had short-term notes payable

totaling $18 million and $62 million at September 29, 2001, and

September 30, 2000, respectively.