Tyson Foods 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

are you ready?

TYSON FOODS, INC. 2001 ANNUAL REPORT

Table of contents

-

Page 1

are you ready? T Y S O N F O O D S , I N C . 2 0 0 1 A N N U A L R E P O RT -

Page 2

... P O RT in millions, except per share data 2001 2000 1999 Sales* Gross profit* Operating income Income before income taxes and minority interest Provision for income taxes Net income Diluted earnings per share Diluted earnings per share before asset impairment and other charges Asset impairment... -

Page 3

we are! Tyson Foods, Inc., founded in 1935 with headquarters in Springdale, Arkansas, is the world's largest processor and marketer of beef, chicken and pork. Tyson Foods produces a wide variety of brand name, processed food products and is the recognized market leader in almost every retail and ... -

Page 4

... as a company focused on customer service, shareholders and team members, making the Tyson name much more valuable. The new company has unrivaled scale, a diverse range of products and a broad customer base. As the meat case moves to case-ready, branded products for beef and pork, Tyson Foods is in... -

Page 5

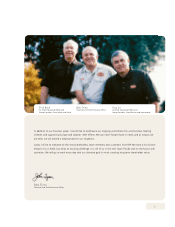

John Tyson Chairman and Chief Executive Officer 27% beef 23% chicken 18% pork MARKET POSITION Source: Watt Poultry USA, Cattle Buyers Weekly and National Pork Producers Council 3 -

Page 6

...by Co-Chief Operating Officer and Group President Dick Bond. The new company's management team identified three areas of potential synergies: consolidated purchasing, integration of general and administrative functions into a shared services infrastructure and transportation and logistics. We expect... -

Page 7

... John Tyson Chairman and Chief Executive Officer Greg Lee Co-Chief Operating Officer and Group President, Food Service and International In addition to our business goals, I would like to emphasize our ongoing commitment to communities, helping children and supporting hunger and disaster relief... -

Page 8

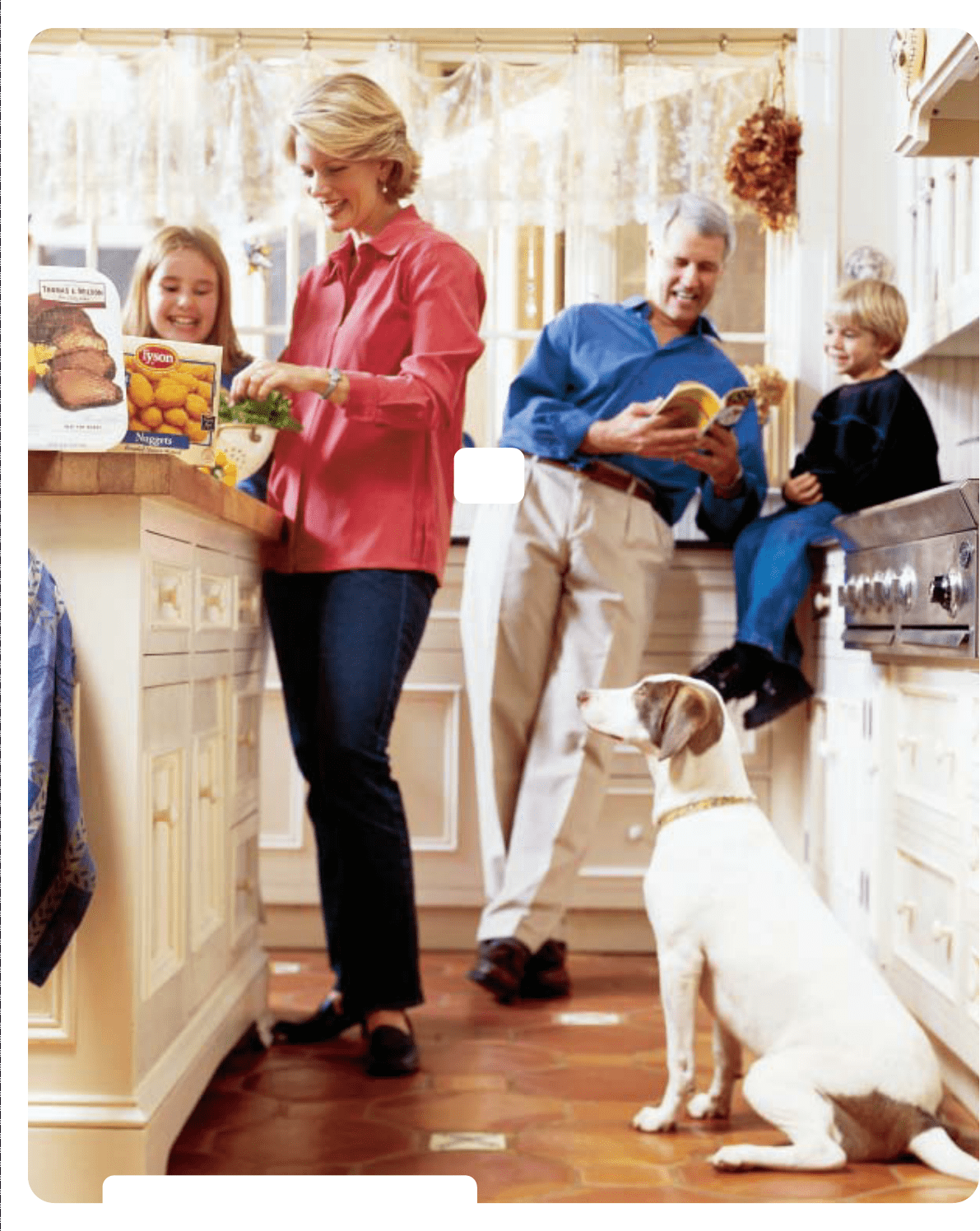

we know what you want. -

Page 9

variety convenience quality taste brand -

Page 10

... and to taste great. Tyson Foods brings consumers quality and convenience in the three major proteins - beef, chicken and pork - by offering a wide array of value-added products. In addition to fresh chicken and Tyson's famous frozen chicken products, Tyson gives consumers choices for fully cooked... -

Page 11

... ready TOP OF MIND CONSUMER B R A N D AWA R E N E S S T R E N D * 47% 40% 51% 1999 2000 2001 With the combination of Tyson Foods and IBP, the new company has a tremendous portfolio of retail and food service brands to complement existing brands in chicken, prepared foods and tortilla products... -

Page 12

the brands 10 -

Page 13

" 11 -

Page 14

we know what's important to you. -

Page 15

service experience results leadership -

Page 16

.... And by using value-added products, particularly fully cooked products, an operator can shift the critical steps in preparation to Tyson, reducing many food safety concerns. Case-ready beef and pork addresses labor issues for retail customers. Case-ready meat is just that - ready to put into the... -

Page 17

... of Tyson Foods before the merger - spent as much on those items as all of Tyson Foods last year. Tyson's new size and scale is having an immediate impact on purchasing power. GENERAL AND ADMINISTRATIVE TRANSPORTATION AND LOGISTICS The integration of supply chain resources will increase service... -

Page 18

we know how to take care of you. -

Page 19

... Usman, Amarillo, Texas; Minnie Sanders, Stilwell Oklahoma; William Whitfield, Springdale, Arkansas; Deb Mazurek, Dakota City, Nebraska; Charles Wheeler, Springdale, Arkansas; Fernando Maias, Noel, Missouri; Gloria Rodriguez, Finney County, Kansas; Barbara Berry Whitley, Dakota Dunes, South Dakota... -

Page 20

... will convert chicken litter and sludge into energy. Our Monett, Missouri, plant was named winner of the first U.S. Poultry and Egg Association's Clean Water Award for pretreatment facilities. And also this year, Southern Company, one of the nation's leading energy companies, gave Tyson Foods the... -

Page 21

commitment respect opportunity respect growth dignity growth dignity commitment opportunity -

Page 22

we know you deserve the best! -

Page 23

... Balance Sheets Consolidated Statements of Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of Independent Auditors Report of Management Eleven-Year Financial Summary Board of Directors Corporate and Executive Officers Corporate Information -

Page 24

...of fiscal 2001, the Company acquired IBP, inc. (IBP). Headquartered in Dakota Dunes, South Dakota, IBP is the world's largest supplier of premium fresh beef and pork products, with more than 60 production sites in North America, joint venture operations in China, Ireland and Russia and sales offices... -

Page 25

... operates in five business segments: Beef, Chicken, Pork, Prepared Foods and Other. The Company measures segment profit as operating income. The following information includes nine weeks results for the period ending September 29, 2001, related to the IBP acquisition, stated prior to adjustments... -

Page 26

... case-ready sales of $116 million. Beef segment operating income totaled $32 million. Beef sales and operating income are derived solely from the operations acquired from IBP, and as such have no comparative data since the Company did not have a beef group prior to the IBP acquisition. Chicken... -

Page 27

... at the end of 1999 due to the anticipated sale of the pork business. The Company's Pork segment includes feeder pig finishing and marketing of swine to regional and national packers. Chicken Pork Prepared Foods Other Total $6,907 157 294 52 $7,410 $6,906 109 301 305 $7,621 $ 1 48 (7) (253... -

Page 28

... of a minimum net worth, current ratio, cash flow coverage of interest and a maximum total debt-to-capitalization ratio. The Company is in compliance with these covenants at fiscal year end. '01 '00 '99 511 587 547 In August 2001, the Company completed the financing for the acquisition of IBP by... -

Page 29

... these positions to fair value through earnings at each reporting date. The Company had reflected a fair value liability of $11 million on its balance sheet at September 29, 2001, related to these non-hedge positions. Interest Rate and Foreign Currency Risks The Company hedges exposure to changes... -

Page 30

...Total Fair value 9/29/01 As of September 29, 2001 Liabilities Long-term debt including current portion Fixed rate Average interest rate Variable rate Average interest rate Interest rate derivative financial instruments related to debt Interest rate swaps Pay fixed Average pay rate Average receive... -

Page 31

... issue involves the accounting and income statement classification for sales subject to rebates and revenue sharing arrangements as well as coupons and discounts. The EITF concluded that sales incentives offered to customers to buy a product should be classified as a reduction of sales. This issue... -

Page 32

... RELEVANT TO FORWARDLOOKING INFORMATION This annual report and other written reports and oral statements made from time to time by the Company and its representatives contain forward-looking statements, including forward-looking statements made in this report, with respect to their current views and... -

Page 33

... of Sales Operating Expenses: Selling, general and administrative Asset impairment and other charges Operating Income Other Expense (Income): Interest Other Income Before Income Taxes and Minority Interest Provision for Income Taxes Minority Interest Net Income Weighted Average Shares Outstanding... -

Page 34

... 2000 Class B-authorized 900 million shares: Issued 103 million shares in 2001 and 2000 Capital in excess of par value Retained earnings Accumulated other comprehensive loss Less treasury stock, at cost - 21 million shares in 2001 and 16 million shares in 2000 Less unamortized deferred compensation... -

Page 35

... Shares Amount Shares Amount Par Value Earnings Shares Amount Compensation Income (Loss) Common Stock Class A Class B Total Shareholders' Equity Balance - October 3, 1998 Comprehensive Income: Net income Other comprehensive income (loss) Total Comprehensive Income Purchase of Treasury Shares... -

Page 36

... payable Net change in other current assets and liabilities Cash Provided by Operating Activities Cash Flows From Investing Activities: Additions to property, plant and equipment Proceeds from sale of assets Net cash paid for IBP acquisition Purchase of Tyson de Mexico minority interest Net change... -

Page 37

... swine. Tyson's wholly owned subsidiary IBP, headquartered in Dakota Dunes, South Dakota, is the world's largest supplier of premium fresh beef and pork products, with more than 60 production sites in North America, joint venture operations in China, Ireland and Russia and sales offices throughout... -

Page 38

...do not meet the criteria for hedge accounting are marked to fair value with unrealized gains or losses reported currently in earnings. The Company generally does not hedge anticipated transactions beyond 12 months. Beef Chicken Pork Prepared Foods Total $1,306 916 350 184 $2,756 Goodwill has been... -

Page 39

... issue involves the accounting and income statement classification for sales subject to rebates and revenue sharing arrangements as well as coupons and discounts. The EITF concluded that sales incentives offered to customers to buy a product should be classified as a reduction of sales. This issue... -

Page 40

... a portion of the total purchase price allocated to assets acquired and liabilities assumed based on estimated fair market value at the date of acquisition. IBP is the world's largest manufacturer of fresh meats and frozen and refrigerated food products, with 2000 annual sales of approximately $17... -

Page 41

... totaling $35 million related to the anticipated loss on the sale and closure of the Pork Group assets. In the first quarter of fiscal 2000, the Company ceased negotiations for the sale 2001 2000 Sales Net income before extraordinary items Net income Earnings per share before extraordinary items... -

Page 42

..., net of gains, totaling approximately $4 million recorded in other comprehensive income (loss) at September 29, 2001, related to cash flow hedges, will be recognized within the next 12 months. The Company generally does not hedge cash flows related to commodities beyond 12 months. Fair value hedges... -

Page 43

... are as follows: in millions 2001 2000 Accrued salaries, wages and benefits Income taxes payable Self insurance reserves Property and other taxes Other Total other current liabilities $222 109 221 63 228 $843 $104 60 102 27 62 $355 NOTE 9: COMMITMENTS The Company leases certain farms and other... -

Page 44

... total debt-tocapitalization ratio. The Company is in compliance with these covenants at fiscal year end. Industrial revenue bonds are secured by facilities with a net book value of $86 million at September 29, 2001. The weighted average interest rate on all outstanding short-term borrowing was... -

Page 45

... information is provided for the Company, as guarantor, and for IBP, as issuer, as an alternative to providing separate financial statements for the issuer. Condensed Consolidating Statement of Income for the year ended September 29, 2001 in millions Tyson IBP Adjustments Consolidated Sales... -

Page 46

...shares of Class A stock with restrictions expiring over periods through July 1, 2020. The unearned portion of the restricted stock is classified on the Consolidated Balance Sheets as deferred compensation in shareholders' equity. Additionally, the Company assumed the IBP officer long-term stock plan... -

Page 47

... CONSOLIDATED FINANCIAL STATEMENTS T Y S O N F O O D S , I N C . 2 0 01 A N N U A L R E P O R T A summary of the Company's stock option activity is as follows: Shares under option Weighted average exercise price per share The number of options exercisable was as follows: September 29, 2001- 9,644... -

Page 48

...million. The purchase price was in excess of the market value as determined by a current independent appraisal. N O T E 14 : I N C O M E TA X E S Detail of the provision for income taxes consists of: in millions 2001 2000 1999 Net Income As reported Pro forma Earnings per share As reported Basic... -

Page 49

... expenses Acquired net operating loss carryforwards All other Valuation allowance Net deferred tax liability $ 9 $412 2001 2000 1999 Numerator: $ 5 $200 Net Income Denominator: - - 9 146 114 90 67 13 - - 2 25 121 - 91 9 Denominator for basic earnings per share - weighted average shares Effect... -

Page 50

... operates in five business segments: Beef, Chicken, Pork, Prepared Foods and Other. The Company measures segment profit as operating income. The following information includes nine weeks results for the period ending September 29, 2001, related to the IBP acquisition, stated prior to adjustment... -

Page 51

... to the Company's new segment reporting: in millions Beef Chicken Pork Prepared Foods Other Consolidated Fiscal year ended September 29, 2001 Sales Operating income (loss) Other expense Income before income taxes and minority interest Depreciation Total assets Additions to property, plant and... -

Page 52

... Company filed the case of M.H. Fox, et al. v. Tyson Foods, Inc. (Fox v. Tyson) in the U.S. District Court for the Northern District of Alabama claiming the Company violated requirements of the Fair Labor Standards Act. The suit alleges the Company failed to pay employees for all hours worked and... -

Page 53

... Protection Agency (EPA), filed a lawsuit against IBP in U.S. District Court for the District of Nebraska, alleging violations of various environmental laws at IBP's Dakota City facility. This action alleges, among other things, violations of: (1) the Clean Air Act; (2) the Clean Water Act; (3) the... -

Page 54

... its Dakota City facility including the installation of a full nitrification system. On the same date, an amended complaint was filed adding Clean Water Act and RCRA allegations involving IBP's former Palestine, Texas, facility, Clean Water Act allegations involving IBP's Gibbon, Nebraska, facility... -

Page 55

...the closing of a new Cash Tender Offer to August 3, 2001. On June 19, 2001, a purported Company stockholder commenced a derivative action in the Delaware Court entitled Foods, Inc. et al. v. IBP , inc., Case No. E 2001-749-4 (the Arkansas Lawsuit), alleging that the Company had been inappropriately... -

Page 56

... claims. General Matters In July 1996, a lawsuit was filed against IBP by certain cattle producers in the U.S. District Court, Middle District of Alabama, seeking certification of a class of all cattle producers. The complaint alleges that IBP has used its market power and alleged "captive supply... -

Page 57

... Foods, Inc., as of September 29, 2001, and September 30, 2000, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended September 29, 2001. These financial statements are the responsibility of the Company's management... -

Page 58

...is continually reviewed and modified in response to changing business conditions and operations and to recommendations made by the independent auditors and the internal auditors. The Company has a code of conduct and an experienced full-time compliance officer. The management of the Company believes... -

Page 59

... related to Tyson de Mexico losses. 4.The results for 1999 include a $77 million pretax charge for loss on sale of assets and impairment write-downs. 5.Significant business combinations accounted for as purchases: IBP, inc., Hudson Foods, Inc. and Arctic Alaska Fisheries Corporation in August 2001... -

Page 60

... Co-Chief Operating Officer and Group President, Fresh Meats and Retail of the Company. Mr. Bond served as President and COO of IBP from 1997 until the merger of IBP into the Company; as President, IBP Fresh Meats; Executive Vice President, IBP Beef Division; and IBP Group Vice President, Beef Sales... -

Page 61

... W. Rea Group Vice President, Prepared Foods Group Kenneth L. Rose Senior Vice President, Indirect Purchasing, Aviation and Travel Donnie Smith Senior Vice President, Supply Chain Management John Tyson Chairman and Chief Executive Officer David L. Van Bebber Senior Vice President, Legal Services 59 -

Page 62

...if possible, the numbers and issue dates of the certificates. STOCK EXCHANGE LISTINGS The Class A common stock of the Company is traded on the New York Stock Exchange under the symbol TSN. C O R P O R AT E H E A D Q U A R T E R S 2210 West Oaklawn Drive Springdale, Arkansas 72762-6999 Telephone (501... -

Page 63

...Tyson currently pays dividends four times a year on March 15, June 15, September 15 and December 15. The dividend is paid to everyone who holds shares on the record date. INDEPENDENT AUDITORS Ernst & Young LLP 425 West Capitol, Suite 3600 Little Rock, AR 72201 Telephone (501) 370-3000 TRANSFER AGENT... -

Page 64

TYSON FOODS, INC. 2210 West Oaklawn Drive Springdale, Arkansas 72762-6999 www.tyson.com