Tesco 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

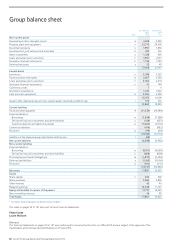

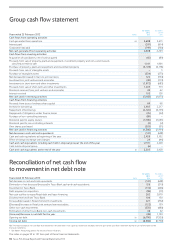

Group cash flow statement

Year ended 25 February 2012 notes

52 weeks

2012

£m

52 weeks

2011*

£m

Cash flows from operating activities

Cash generated from operations 29 5,688 5,613

Interest paid (531) (614)

Corporation tax paid (749) (760)

Net cash generated from operating activities 4,408 4,239

Cash flows from investing activities

Acquisition of subsidiaries, net of cash acquired (65) (89)

Proceeds from sale of property, plant and equipment, investment property and non-current assets

classified as held for sale 1,141 1,906

Purchase of property, plant and equipment and investment property (3,374) (3,178)

Proceeds from sale of intangible assets –3

Purchase of intangible assets (334) (373)

Net decrease/(increase) in loans to joint ventures 122 (194)

Investments in joint ventures and associates (49) (174)

Investments in short-term and other investments (1,972) (683)

Proceeds from sale of short-term and other investments 1,205 719

Dividends received from joint ventures and associates 40 62

Interest received 103 128

Net cash used in investing activities (3,183) (1,873)

Cash flows from financing activities

Proceeds from issue of ordinary share capital 69 98

Increase in borrowings 2,905 2,217

Repayment of borrowings (2,720) (4,153)

Repayment of obligations under finance leases (45) (42)

Purchase of non-controlling interests (89) –

Dividends paid to equity owners (1,180) (1,081)

Dividends paid to non-controlling interests (3) (2)

Own shares purchased (303) (31)

Net cash used in financing activities (1,366) (2,994)

Net decrease in cash and cash equivalents (141) (628)

Cash and cash equivalents at beginning of the year 2,428 3,102

Effect of foreign exchange rate changes 24 (46)

Cash and cash equivalents including cash held in disposal group at the end of the year 2,311 2,428

Cash held in disposal group (6) –

Cash and cash equivalents at the end of the year 18 2,305 2,428

Reconciliation of net cash flow

to movement in net debt note

Year ended 25 February 2012 note

52 weeks

2012

£m

52 weeks

2011*

£m

Net decrease in cash and cash equivalents (141) (628)

Elimination of net decrease/(increase) in Tesco Bank cash and cash equivalents 126 (219)

Investment in Tesco Bank (112) (446)

Debt acquired on acquisition (98) (17)

Net cash outflow to repay Retail debt and lease financing 262 2,870

Dividend received from Tesco Bank 100 150

Increase/(decrease) in Retail short-term investments 221 (292)

(Decrease)/increase in Retail joint venture loan receivables (122) 159

Other non-cash movements (330) (480)

Elimination of other Tesco Bank non-cash movements 46 42

(Increase)/decrease in net debt for the year (48) 1,139

Opening net debt 30 (6,790) (7,929)

Closing net debt 30 (6,838) (6,790)

NB. The reconciliation of net cash flow to movement in net debt note is not a primary statement and does not form part of the cash flow statement but forms part of the notes to the

financial statements.

* See Note 1 Accounting policies for details of reclassifications.

The notes on pages 95 to 141 form part of these financial statements.

94 Tesco PLC Annual Report and Financial Statements 2012