Tesco 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of the Audit Committee and the other Board committees are

distributed to the Board and each Committee submits a report

for formal discussion at least once a year. These processes provide

assurance that the Group is operating legally, ethically and in

accordance with approved financial and operational policies.

Audit Committee

The Audit Committee reports to the Board each year on its review of

the effectiveness of the internal control systems for the financial year

and the period to the date of approval of the financial statements.

Throughout the year the Committee receives regular reports from

the external auditors covering topics such as quality of earnings and

technical accounting developments. The Committee also receives

updates from Internal Audit and has dialogue with senior managers on

their control responsibilities. It should be understood that such systems

are designed to provide reasonable, but not absolute, assurance against

material misstatement or loss.

Internal Audit

The Internal Audit department is independent of business operations

and has a Group-wide mandate. It undertakes a programme to

address internal control and risk management processes with

particular reference to the Turnbull Guidance. It operates a risk-based

methodology, ensuring that the Group’s key risks receive appropriate

regular examination. Its responsibilities include maintaining the Key

Risk Register, reviewing and reporting on the effectiveness of risk

management systems and internal control with the Executive

Committee, the Audit Committee and ultimately to the Board. Internal

Audit facilitates oversight of risk and control systems across the Group

through risk committees in Asia, Europe and Tesco Bank and audit

committees in a number of our businesses and joint ventures.

The Head of Internal Audit also attends all Audit Committee meetings.

External audit

PwC, the Company’s external auditor, contributes a further

independent perspective on certain aspects of our internal financial

control systems arising from its work, and reports to both the Board

and the Audit Committee. The engagement and independence of

external auditors is considered annually by the Audit Committee

before it recommends its selection to the Board.

The Company has a Non-audit services policy for work carried out by

PwC. This is split into three categories as explained below:

pre-approved for the external auditors – is predominantly the review

of subsidiary undertakings’ statutory accounts and is audit-related

innature;

work for which Committee approval is specifically required –

transaction work and corporate tax services, and certain advisory

services; and

work from which the external auditors are prohibited.

The Audit Committee concluded that it was in the best interests of the

Company for the external auditors to provide a number of non-audit

services during the year due to their experience, expertise, and

knowledge of the Group’s operation.

Auditor objectivity and independence was achieved by ensuring

that personnel involved in the non-audit work were not involved in

the audit, and by ensuring that management took responsibility for

all decisions made.

The fees paid to the Auditors in the year are disclosed in Note 3 to the

Group financial statements.

PwC also follows its own ethical guidelines and continually reviews its

audit team to ensure its independence is not compromised. PwC’s

independence is also considered by the Audit Committee regularly.

oversee the Finance Risk Register. The Board assesses significant

social, environmental and ethical (‘SEE’) risks to the Group’s short and

long-term value, and incorporates SEE risks into the Key Risk Register

where they are considered material or appropriate. During the year

the Board regularly reviewed the Risk Register and also undertook

an in-depth assessment of product safety.

We recognise the value of the ABI Guidelines on Responsible

Investment Disclosure and confirm that, as part of its regular risk

assessment procedures, the Board takes account of the significance

of SEE matters to the business of the Group. We recognise that a

number of investors and other stakeholders take a keen interest in how

companies manage SEE matters and so we report more detail on our

SEE policies and approach to managing material risks arising from SEE

matters and the KPIs we use both on our website (www.tescoplc.com/

plc/corporate_responsibility/) and in our Corporate Responsibility

Review 2012. To provide further assurance, the Group’s Corporate

Responsibility KPIs are audited on a regular basis by Internal Audit.

Internal controls

The Board is responsible for the Company’s system of internal controls

and for reviewing the effectiveness of such a system. We have a

Group-wide process for clearly establishing the risks and responsibilities

assigned to each level of management and the controls which are

required to be operated and monitored.

The CEO of each subsidiary business is required to certify by way

of an annual governance return that the Group’s governance and

compliance policies and processes have been adopted. The returns

received from across the Group are reviewed and discussed by the

Compliance Committee and the results of that review are also

considered by the Audit Committee as part of the Annual Assessment

of Risk Management and Internal Controls, which is prepared by

Internal Audit as part of the year end process. For certain joint ventures,

the Board places reliance upon the internal control systems operating

within our partners’ infrastructure and the obligations upon partners’

boards relating to the effectiveness of their own systems.

Such a system is designed to manage rather than eliminate the risk of

failure to achieve business objectives and can only provide reasonable

and not absolute assurance against material misstatement or loss.

In respect of Group financial reporting, Group Finance is responsible

for preparing the Group financial statements, using a well-controlled

consolidation process. Group Finance contains a technical accounting

team, which reviews external technical accounting developments,

financial reporting and accounting policy issues. It is also responsible

for the maintenance of the Group’s accounting policy manual, which is

in accordance with International Financial Reporting Standards. Group

Finance maintains its own risk register and assesses its own controls

systems. This incorporates risks such as wrong or unclear accounting

policies, ineffective financial close processes, inaccurate or incomplete

Group financial and management accounts, reputational risk, IT

risks, fraud and people risks. Group Internal Audit also reviews the

effectiveness of controls operating in the Group Finance function.

The results of Group Finance’s risk register review and Group Internal

Audit’s findings are reported to the Audit Committee on an

annualbasis.

The Board has conducted a review of the effectiveness of internal

controls and is satisfied that the controls in place remain appropriate.

Monitoring

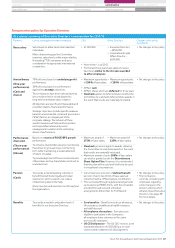

The Board oversees the monitoring system and has set specific

responsibilities for itself and the various committees as set out below.

Both Internal Audit and our external auditors play key roles in the

monitoring process, as do several committees including the Compliance

Committee and the Corporate Responsibility Committee. The minutes

Tesco PLC Annual Report and Financial Statements 2012 61

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTSOVERVIEW

General information Directors’ remuneration reportBoard of Directors Principal risks and uncertainties Corporate governance