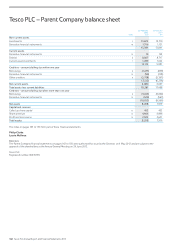

Tesco 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

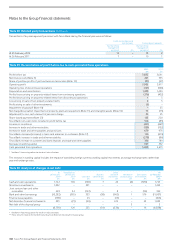

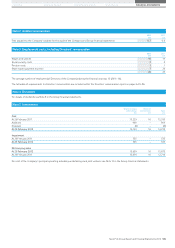

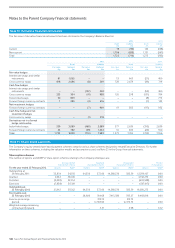

Note 10 Derivative financial instruments

The fair value of derivative financial instruments has been disclosed in the Company’s Balance Sheet as:

2012 2011

Asset

£m

Liability

£m

Asset

£m

Liability

£m

Current 19 (90) 142 (138)

Non-current 1,706 (620) 1,131 (567)

Total 1,725 (710) 1,273 (705)

2012 2011

Asset Liability Asset Liability

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

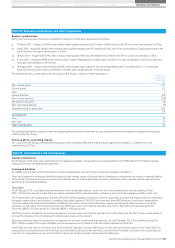

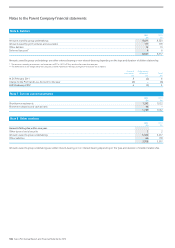

Fair value hedges

Interest rate swaps and similar

instruments 81 1,065 – – 13 665 (21) 400

Cross currency swaps 818 2,686 (8) 269 728 2,674 (39) 714

Cash flow hedges

Interest rate swaps and similar

instruments ––(132)400 ––(54)400

Cross currency swaps 233 304 (41) 988 126 298 (151) 784

Index-linked swaps 30 809 – – – – (8) 772

Forward foreign currency contracts 1285 (4)616 –– (1)145

Net investment hedges

Forward foreign currency contracts ––(7)96919 383 (97) 952

Cash flow hedge and net

investment hedges

Cross currency swaps ––(1)318 –– ––

Derivatives not in a formal

hedge relationship

Index-linked swaps 539 3,089 (468) 3,089 377 2,639 (310) 2,639

Forward foreign currency contracts 23 782 (49) 1,034 10 400 (24) 550

Total 1,725 9,020 (710) 7,683 1,273 7,059 (705) 7,356

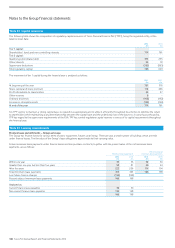

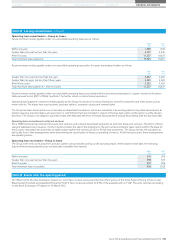

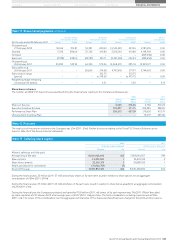

Note 11 Share-based payments

The Company’s equity-settled share-based payment schemes comprise various share schemes designed to reward Executive Directors. For further

information on these schemes, including the valuation models and assumptions used, see Note 25 in the Group financial statements.

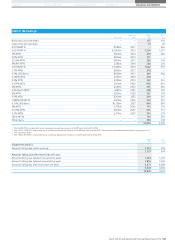

Share option schemes

The number of options and WAEP of share option schemes relating to the Company employees are:

For the year ended 25 February 2012

Savings-related

share option scheme

Approved

share option scheme

Unapproved

share option scheme

Nil cost

share options

Options WAEP Options WAEP Options WAEP Options WAEP

Outstanding at

26 February 2011 33,834 342.93 64,330 373.06 14,368,570 385.59 12,399,127 0.00

Granted 4,944 364.00 – – – – 4,742,273 0.00

Forfeited (5,028) 343.54 – – – – (603,508) 0.00

Exercised (7,838) 313.89 – – – – (507,617) 0.00

Outstanding at

25 February 2012 25,912 355.62 64,330 373.06 14,368,570 385.59 16,030,275 0.00

Exercisable as at

25 February 2012 – – 28,600 314.68 7,413,586 395.27 9,468,818 0.00

Exercise price range

(pence) – – –

312.75

to 318.60 –

312.75

to 473.75 – 0.00

Weighted average remaining

contractual life (years) – – – 3.51 – 4.98 – 6.12

Notes to the Parent Company financial statements

148 Tesco PLC Annual Report and Financial Statements 2012