Tesco 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements

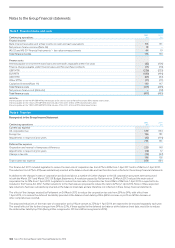

Cash and cash equivalents

Cash and cash equivalents in the Group Balance Sheet consist of cash at

bank, in hand, demand deposits with banks, loans and advances to banks,

certificate of deposits and other receivables together with short-term

deposits with an original maturity of three months or less.

Non-current assets held for sale

Non-current assets and disposal groups are classified as held for sale

if their carrying amount will be recovered through sale rather than

continuing use. Non-current assets (and disposal groups) classified as

held for sale are measured at the lower of carrying amount and fair

value less costs to sell.

Leasing

Leases are classified as finance leases whenever the terms of the lease

transfer substantially all the risks and rewards of ownership to the lessee.

All other leases are classified as operating leases.

The Group as a lessor

Amounts due from lessees under finance leases are recorded as

receivables at the amount of the Group’s net investment in the leases.

Finance lease income is allocated to accounting periods so as to reflect a

constant periodic rate of return on the Group’s net investment in the lease.

Rental income from operating leases is recognised on a straight-line basis

over the term of the lease.

The Group as a lessee

Assets held under finance leases are recognised as assets of the Group

at their fair value or, if lower, at the present value of the minimum

lease payments, each determined at the inception of the lease.

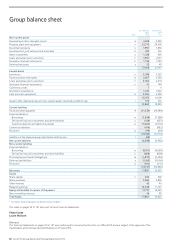

The corresponding liability is included in the Group Balance Sheet as

a finance lease obligation. Lease payments are apportioned between

finance charges and a reduction of the lease obligations so as to achieve

a constant rate of interest on the remaining balance of the liability.

Finance charges are charged to the Group Income Statement. Rentals

payable under operating leases are charged to the Group Income

Statement on a straight-line basis over the term of the lease.

Sale and leaseback

A sale and leaseback transaction is one where the Group sells an asset

and immediately reacquires the use of the asset by entering into a lease

with the buyer.

The accounting treatment of the sale and leaseback depends upon the

substance of the transaction (by applying the lease classification principles

described above) and whether or not the sale was made at the asset’s

fairvalue.

For sale and finance leasebacks, any profit from the sale is deferred

and amortised over the lease term. For sale and operating leasebacks,

generally the assets are sold at fair value, and accordingly the profit or loss

from the sale is recognised immediately in the Group Income Statement.

Post-employment and similar obligations

For defined benefit plans, obligations are measured at discounted present

value (using the projected unit credit method) whilst plan assets are

recorded at fair value. The operating and financing costs of such plans are

recognised separately in the Group Income Statement; service costs are

spread systematically over the expected service lives of employees and

financing costs are recognised in the periods in which they arise. Actuarial

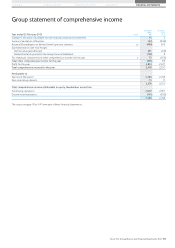

gains and losses are recognised immediately in the Group Statement of

Comprehensive Income.

Payments to defined contribution schemes are recognised as an expense

as they fall due.

Share-based payments

The fair value of employee share option plans is calculated at the grant

date using the Black-Scholes model. The resulting cost is charged to the

Group Income Statement over the vesting period. The value of the charge

is adjusted to reflect expected and actual levels of vesting.

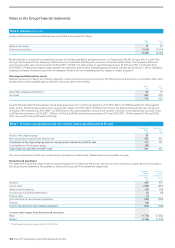

Taxation

The tax expense included in the Group Income Statement consists of

current and deferred tax.

Current tax is the expected tax payable on the taxable income for the year,

using tax rates enacted or substantively enacted by the balance sheet date.

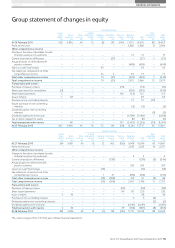

Tax expense is recognised in the Group Income Statement except to the

extent that it relates to items recognised in the Group Statement of Other

Comprehensive Income or directly in the Group Statement of Changes

in Equity, in which case it is recognised in the Group Statement of Other

Comprehensive Income or directly in the Group Statement of Changes in

Equity, respectively.

Deferred tax is provided using the balance sheet liability method, providing

for temporary differences between the carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for

taxation purposes.

Deferred tax is calculated at the tax rates that have been enacted or

substantively enacted by the balance sheet date. Deferred tax is charged

orcredited in the Group Income Statement, except when it relates to items

charged or credited directly to equity or other comprehensive income,

inwhich case the deferred tax is also recognised in equity, or other

comprehensive income, respectively.

Deferred tax assets are recognised to the extent that it is probable that

taxable profits will be available against which deductible temporary

differences can be utilised.

The carrying amount of deferred tax assets is reviewed at each balance

sheet date and reduced to the extent that it is no longer probable that

sufficient taxable profits will be available to allow all or part of the assets

tobe recovered.

Deferred tax assets and liabilities are offset against each other when

thereis a legally enforceable right to set-off current taxation assets

againstcurrent taxation liabilities and it is the intention to settle these

onanet basis.

Foreign currencies

Transactions in foreign currencies are translated at the exchange rate on

the date of the transaction. At each balance sheet date, monetary assets

and liabilities that are denominated in foreign currencies are retranslated

atthe rates prevailing on the balance sheet date. All differences are taken

to the Group Income Statement.

The assets and liabilities of overseas subsidiaries denominated in

foreign currencies are translated into Pound Sterling at exchange rates

prevailing at the date of the Group Balance Sheet; profits and losses are

translated ataverage exchange rates for the relevant accounting periods.

Exchange differences arising are recognised in the Group Statement of

Comprehensive Income and are included in the Group’s translation

reserve. Such translation differences are recognised as income or

expensesin the period in which the operation is disposed of.

Note 1 Accounting policies continued

98 Tesco PLC Annual Report and Financial Statements 2012