Tesco 2012 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

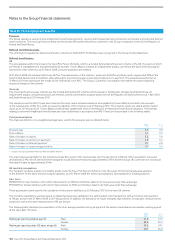

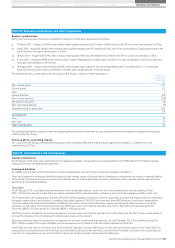

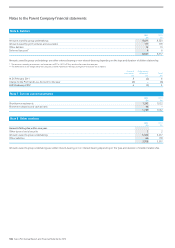

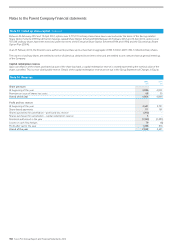

Fair value hedging

Derivative financial instruments are classified as fair value hedges when

they hedge the Company’s exposure to changes in the fair value of a

recognised asset or liability. Changes in the fair value of derivatives that

are designated and qualify as fair value hedges are recorded in the

Company Profit and Loss Account, together with any changes in the

fair value of the hedged item that is attributable to the hedged risk.

Cash flow hedging

Derivative financial instruments are classified as cash flow hedges when

they hedge the Company’s exposure to variability in cash flows that are

either attributable to a particular risk associated with a recognised asset

or liability, or a highly probable forecasted transaction.

The effective element of any gain or loss from remeasuring the

derivative instrument is recognised directly in equity.

The associated cumulative gain or loss is removed from equity and

recognised in the Company Profit and Loss Account in the same

period during which the hedged transaction affects the Company

Profit and Loss Account. The classification of the effective portion

when recognised in the Company Profit and Loss Account is the same

as the classification of the hedged transaction. Any element of the

remeasurement criteria of the derivative instrument which does not

meet the criteria for an effective hedge is recognised immediately

in the Company Profit and Loss Account.

Hedge accounting is discontinued when the hedging instrument

expires or is sold, terminated or exercised, no longer qualifies for

hedge accounting or is de-designated. At that point in time, any

cumulative gain or loss on the hedging instrument recognised in

equity is retained in equity until the forecasted transaction occurs

or the original hedged item affects the Parent Company Profit and

Loss Account. If a forecasted hedged transaction is no longer expected

to occur, the net cumulative gain or loss recognised in equity is

transferred to the Company Profit and Loss Account.

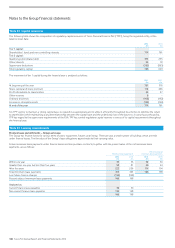

Pensions

The Company participates in the Tesco PLC Pension Scheme which is

a multi-employer scheme within the Tesco Group and cannot identify

its share of the underlying assets and liabilities of the scheme. Accordingly,

as permitted by FRS 17 ‘Retirement Benefits’, the Company has

accounted for the scheme as a defined contribution scheme, and the

charge for the period is based upon the cash contributions payable.

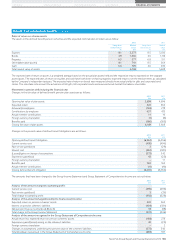

Taxation

Corporation tax payable is provided on the taxable profit for the year,

using the tax rates enacted or substantively enacted by the Balance

Sheet date.

Deferred tax is recognised in respect of all timing differences that have

originated but not reversed at the Balance Sheet date and would give

rise to an obligation to pay more or less tax in the future.

Deferred tax assets are recognised to the extent that they are

recoverable. They are regarded as recoverable to the extent that on

the basis of all available evidence, it is regarded as more likely than

not that there will be suitable taxable profits from which the future

reversal of the underlying timing differences can be deducted.

Deferred tax is measured on a non-discontinued basis at the tax

rates that are expected to apply in the periods in which the timing

differences reverse, based on tax rates and laws that have been

substantively enacted by the Balance Sheet date.

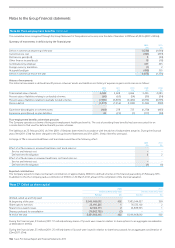

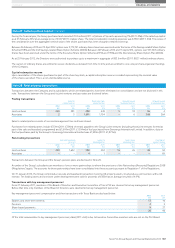

Note 1 Accounting policies continued

Notes to the Parent Company financial statements

144 Tesco PLC Annual Report and Financial Statements 2012