Tesco 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

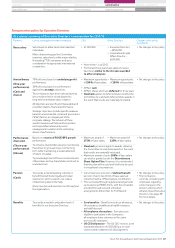

At a glance summary of Executive Directors’ remuneration for 2012/13

Element Link to strategy/performance measures CEO Other Directors Changes to the policy

for 2012/13

Base salary Set at levels to attract and retain talented

individuals.

When determining pay the Committee

examines salary levels at the major retailers,

the leading FTSE companies andgives

consideration to appropriate international

competitors.

'"'&&"&&&$ ;n[Ykj_l[:_h[Yjehi

Å.+("&&&$

9ehfehWj[WdZB[]Wb

Affairs Director –

,)/"&&&$

DeY^Wd][ijej^[feb_Yo$

D[njh[l_[m'@kbo(&'($

<ehj^[bWijj^h[[o[WhiXWi[iWbWho_dYh[Wi[i

have been similar to the increase awarded

to other employees.

Annual bonus

(One-year

performance)

(Cash and

shares)

70% of bonus based on underlying profit

performance.

30% of bonus based on performance

against key strategic objectives.

These measures have been selected as they

are considered to be closely aligned to

long-term shareholder value creation.

All objectives are specific and measurable and

anumber relate to financial performance.

Strategic objectives include specific measures

based on environmental, social and governance

(‘ESG’) factors, an integral part of the

corporate strategy. The inclusion of these

specific measures will help reinforce positive

and responsible behaviour bysenior

management in relation to the underlying

drivers of performance.

CWn_ckceffehjkd_jo

of 250% of base salary.

CWn_ckceffehjkd_jo

of 200% of base salary.

DeY^Wd][ijej^[feb_Yo$

+&_dcash.

+&_di^Wh[im^_Y^Wh[deferred for three years.

Clawback applies to deferred shares to allow the

Committee to scale back deferred share awards in

the event that results are materially misstated.

Performance

share plan

(Three-year

performance)

(Shares)

Based on a matrix of ROCE/EPS growth

performance.

To enhance shareholder value by incentivising

Executives to grow earnings over the long

term while maintaining a sustainable level

ofreturn of capital.

To provide alignment of the economic interests

of Executives and our shareholders and to act as

a retention tool.

CWn_ckcWmWhZe\

275% of base salary.

CWn_ckcWmWhZe\

225% of base salary.

DeY^Wd][ijej^[feb_Yo$

Clawback provisions apply to awards, allowing

the Committee to scale back awards in the event

that results are materially misstated.

CWn_ckcWmWhZie\kfje200% of base salary

can also be granted under the Discretionary

Share Option Plan. However, it is not intended

that this plan will be used and it will only be used

in exceptional circumstances.

Pension

(Cash)

To provide a market-leading retirement

benefit that will foster loyalty and retain

experience, which supports our culture

ofdeveloping talent internally.

A key incentive and retention tool throughout

the organisation.

9khh[djf[di_edfhel_i_ede\defined benefit

pension of up to two-thirds of base salary at

retirement with a 10% employee contribution.

J^_i_ifhel_Z[Zj^hek]^h[]_ij[h[ZWhhWd][c[dji

up to approved HMRC limits, with the remainder

provided through secured unfunded

arrangements (other than for Tim Mason).

DeY^Wd][ijej^[feb_Yo$

J^[9ecfWdo_i

currently consulting with

employees regarding

some changes to the

pension scheme which

will also impact Executive

Directors. See page 68

for more details.

Benefits To provide a market-competitive level of

benefits for our Executive Directors.

Core benefits – Benefits include car allowance,

life assurance, disability and health insurance,

andstaff discount.

All employee share plans – Executives are

eligible to participate in the Company’s

all-employee share schemes on the same

terms asUK employees.

US CEO allowance – The US CEO receives a net

[nfWjh_Wj[WbbemWdY[e\(.("&&&f$W$jeYel[h

costs incurred in relation to his US assignment.

DeY^Wd][ijej^[feb_Yo$

Remuneration policy for Executive Directors

Tesco PLC Annual Report and Financial Statements 2012 67

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTSOVERVIEW

General information Directors’ remuneration reportBoard of Directors Principal risks and uncertainties Corporate governance