Tesco 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Short-term performance

Performance measures and payouts

Performance measures Maximum opportunity 2011/12 payout

70% based on

profitability

Underlying profit performance CEO – Maximum bonus opportunity

of 250% of base salary.

Other Executive Directors –

Maximum bonus opportunity of 200%

of base salary.

13.54% of maximum opportunity.

TheCEO elected not to take a bonus.

0% of salary for the CEO and 27%

ofsalary for other Directors.

0% of financial performance met

and45% of strategic performance

objectives met.

30% based

on strategic

performance

1. UK like-for-like sales growth

2. UK return on capital employed

3. Group new space expansion

4. Group internet sales

5. Group CO2 reduction

6. Group employee satisfaction

The following illustrates performance against short-term targets.

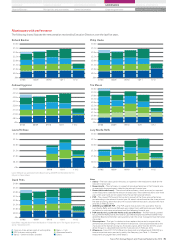

Performance against short-term targets 2011/12

Performance

Measures Below Threshold Target Stretch

Profitability Underlying profit

Strategic UK like-for-like sales growth

UK return on capital employed

Group new space expansion

Group internet sales

Group CO2 reduction

Group employee satisfaction

Despite year-on-year profit growth, our stretching underlying profit growth targets were not met and therefore no bonus will be paid in respect this

portion of the bonus. However, satisfactory performance was delivered in respect of a number of our strategic objectives, particularly Group internet

sales, Group CO2 reduction and Group employee satisfaction and therefore a total of 13.54% of the maximum bonus will be paid to Executive

Directors. TheCEO elected not to take a bonus for 2011/12.

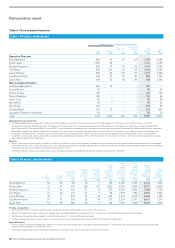

Long-term performance

Vesting of 2009/10 to 2011/12 awards

Awards vesting in the year were made under the previous long-term incentive arrangements, comprising both share options and performance

related shares. The performance conditions applying to these awards and achievement against these targets are summarised below:

Performance measures and payouts

Maximum opportunity 2011/12 payout

Earnings

per share

<_hij'&&ikX`[Yjjej^[WY^_[l[c[dje\

underlying diluted EPS growth of at least RPI plus

9% over three years and the balance vesting for

achieving growth of at least RPI plus 15% over

three years.

=hWdj[Z_d(&&/%'&$

F[h\ehcWdY[f[h_eZ[dZ[Z(&''%'($

I^Wh[efj_edim_j^W\WY[lWbk[

of 200% of salary at the date

ofgrant.

100% of maximum opportunity

vested.

100% vesting

200% vesting

Te s c o

EPS growth above RPI over three years

0%

5%

10%

15%

20% Underlying diluted EPS for 2011/12 excludes the discontinued Japan business and was 37.41p. The

Committee determined, however, that it was appropriate to base vesting of share option awards on

EPS including the impact of Japan to ensure alignment with shareholders.

On this basis, the growth in undiluted EPS above RPI during the performance period exceeded 15%

over three years and these options will therefore vest in fullon the third anniversary of their grant.

Despite the challenges in 2011/12 earnings, performance is still significantly ahead of 2008/9

performance representing significant value creation for shareholders over this period.

The exercise price for awards is 338.4p per share. At the year end the share price was 318.2p and the

share options granted in 2009 were therefore underwater. No value will be delivered to Executives

unless the share price increases significantly above this level.

Directors’ remuneration report

72 Tesco PLC Annual Report and Financial Statements 2012