Tesco 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STRATEGIC REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS

OVERVIEW

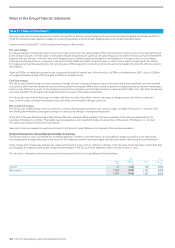

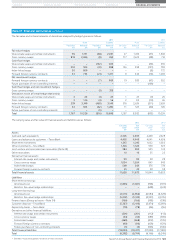

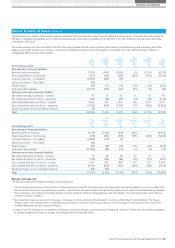

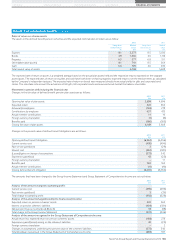

Note 22 Financial risk factors continued

Tesco Bank

Interest rate risk

Interest rate risk arises where assets and liabilities in Tesco Bank’s banking activities have different repricing dates. Tesco Bank policy seeks to minimise the

sensitivity of net interest income to changes in interest rates. Potential exposures to interest rate movements in the medium to long term are measured

and controlled through position and sensitivity limits. Short-term exposures are measured and controlled in terms of net interest income sensitivity over

12months to a 1% parallel movement in interest rates. Tesco Bank also use Economic Value Equity (‘EVE’) for risk management purposes with focus on

the value of Tesco Bank in today’s interest rate environment and its sensitivity to changes in interest rates. Interest rate risk is managed using interest rate

swaps as the main hedging instrument.

Liquidity risk

Liquidity risk is the risk that Tesco Bank is unable to meet its payment obligations as they fall due. Liquidity risk is managed within Tesco Bank’s banking

activities and adheres to the liquidity requirements set by the FSA. Tesco Bank’s Board has set a defined liquidity risk policy and contingency funding

which is prudent and in excess of the minimum requirements as set out by the FSA and by Tesco Bank. A diversified portfolio of high-quality liquid and

marketable assets is maintained. Cash flow commitments and marketable asset holdings are measured and managed on a daily basis. Tesco Bank has

sufficient liquidity to meet all foreseeable outflow requirements as they fall due and its liquidity risk is further mitigated by its well diversified retail

deposit base and a pool of surplus cash resources that are invested in a range of marketable assets.

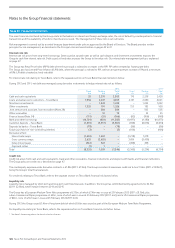

Credit risk

Credit risk is the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms. Credit risk principally

arises from the Bank’s retail lending activities but also from the placement of surplus funds with other banks and money market funds, investments in

transferable securities and interest rate and foreign exchange derivatives. In addition, credit risk arises from contractual arrangements with third parties

where payments and commissions are due to the Bank for short periods of time.

Retail credit policy is managed through the credit risk policy framework with standards and limits defined at all stages of the customer lifecycle, including

new account sanctioning, customer management and collections and recovery activity. Customer lending decisions are managed principally through the

deployment of bespoke credit scorecard models and credit policy rules, which exclude specific areas of lending, and an affordability assessment which

determines a customer’s ability to repay an outstanding credit amount. Wholesale credit risk is managed using a limit-based framework, with limits

determined by counterparty credit worthiness, instrument type and remaining tenor. A limits framework is also in place for the management of third

party credit exposures.

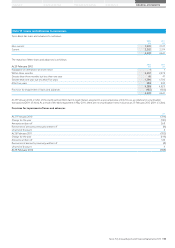

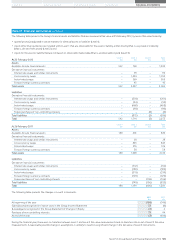

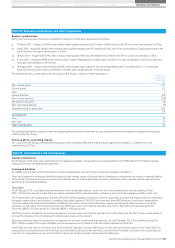

Expressed as an annual probability of default, the upper and lower boundaries and the midpoint for each of the asset quality grades are as follows:

At 25 February 2012 and 26 February 2011

Annual probability of default

Asset quality grade Minimum

%

Midpoint

%

Maximum

%

S&P

equivalent

AQ1 0.00 0.10 0.20 AAA to BBB-

AQ2 0.21 0.40 0.60 BB+ to BB

AQ3 0.61 1.05 1.50 BB- to B+

AQ4 1.51 3.25 5.00 B+ to B

AQ5 5.01 52.50 100.00 B and below

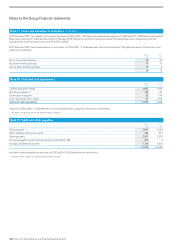

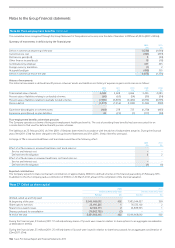

At 25 February 2012 AQ1

£m

AQ2

£m

AQ3

£m

AQ4

£m

AQ5

£m

Accruing

past due

£m

Non-

accrual

£m

Impairment

provision

£m

Total

£m

Assets:

Other investments 1,526 – – – – – – – 1,526

Loans and advances to customers 630 977 866 690 1,158 73 194 (185) 4,403

Total assets 2,156 977 866 690 1,158 73 194 (185) 5,929

Commitments 4,471 1,716 662 426 147 – – – 7,422

Total off-balance sheet 4,471 1,716 662 426 147 – – – 7,422

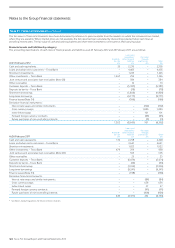

During the financial year, there was a change in the methodology which Tesco Bank uses to measure the customer risk in relation to outstanding loan

balances. As a result this has revised the categorisation of some customer accounts since the prior year end in terms of asset quality grading. Despite this

change in methodology and the resulting impact on the data presented, there has not been any significant change in the underlying quality of the loans

portfolio year on year.

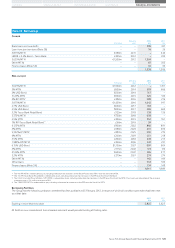

At 26 February 2011*AQ1

£m

AQ2

£m

AQ3

£m

AQ4

£m

AQ5

£m

Accruing

past due

£m

Non-

accrual

£m

Impairment

provision

£m

Total

£m

Assets:

Other investments 938–––– – – –938

Loans and advances to customers 599 466 924 1,663 886 73 212 (182) 4,641

Total assets 1,537 466 924 1,663 886 73 212 (182) 5,579

Commitments 4,254 1,601 645 444 183 – – – 7,127

Total off-balance sheet 4,254 1,601 645 444 183 – – – 7,127

* See Note 1 Accounting Policies for details of reclassifications. Tesco PLC Annual Report and Financial Statements 2012 129