Suzuki 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 49

Consolidated Financial Statements

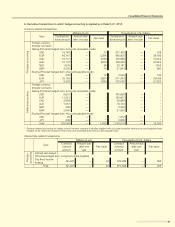

(c) Overseas sales

Millions of yen

2010

Europe North America Asia Other areas*2 Consolidated

Overseas sales .......................... ¥451,145 ¥131,824 ¥771,726 ¥161,808 ¥1,516,504

Consolidated net sales .............................................................................................................2,469,063

Ratio of overseas sales to

consolidated net sales ............. 18.3% 5.3% 31.3% 6.6% 61.4%

Millions of yen

2009

Europe North America Asia Other areas*2 Consolidated

Overseas sales .......................... ¥737,945 ¥234,766 ¥791,829 ¥274,780 ¥2,039,321

Consolidated net sales .............................................................................................................3,004,888

Ratio of overseas sales to

consolidated net sales ............. 24.6% 7.8% 26.4% 9.1% 67.9%

Thousands of U.S. dollars

2010

Europe North America Asia Other areas*2 Consolidated

Overseas sales .......................... $4,848,944 $1,416,859 $8,294,561 $1,739,123 $16,299,489

Consolidated net sales ...........................................................................................................26,537,654

Ratio of overseas sales to

consolidated net sales ............. 18.3% 5.3% 31.3% 6.6% 61.4%

*2 “Other areas” consists principally of Oceania and South America.

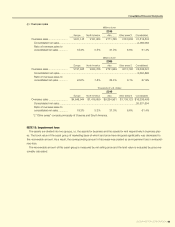

NOTE 15:Impairmentloss

The assets are divided into two groups, i.e. the assets for business and the assets for rent respectively in business plac-

es. The book value of the asset group of marketing base of which land price have dropped signicantly was decreased to

the recoverable amount. As a result, the corresponding amount of decrease was posted as an impairment loss in extraordi-

nary loss.

The recoverable amount of this asset group is measured by net selling price and the land value is evaluated by price rea-

sonably calculated.