Suzuki 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 SUZUKI MOTOR CORPORATION

(Additional Information)

The “Accounting Standard for Financial Instruments” (Accounting Standards Board of Japan; ASBJ Statement

No.10, March 10, 2008) and “Guidance on Accounting Standard for Financial Instruments (ASBJ Guidance No.

19, March 10, 2008) are applied from this scal year.

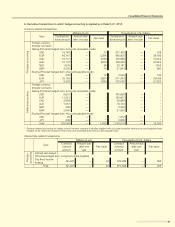

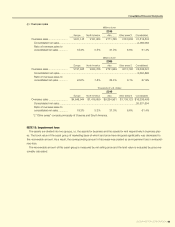

NOTE 5:Short-termborrowingsandlong-termdebt

Short-term borrowings as of March 31, 2010 and 2009 consisted of the following. The annual interest rates of short-term

borrowings as of March 31, 2010 were 0.40 percent to 12.00 percent.

“The zero coupon convertible bonds with 130% call option” are convertible into common stock at the options of holders at

the conversion price of ¥3,021.60 per share.

If the outstanding convertible bonds were fully converted as of March 31, 2010, 49,634,299 additional shares of common

stock would be issued.

As is customary in Japan, both short-term and long-term bank loans are subject to general agreements which provide that

the banks may, under certain circumstances, request additional security for those loans, and may treat any security furnished

to the banks, as well as cash deposited with them, as security for all present and future indebtedness.

Remarks: Because the offer price per share of 3,660,000 new shares (the amount to be paid in under the Companies

Act of Japan) issued on June 23, 2010 as the issue date, executed in accordance with a resolution on the

offer of shares to be issued by third-party allotment adopted at the meeting of the Board of Directors held

on June 3, 2010, fell below the current market price as dened in the terms and conditions of the bonds,

the Company has adjusted the conversion price of the bonds from 3,021.60 to 3,020.20 in accordance

with terms and conditions of the bonds.

Millions of yen

Thousands of

U.S. dollars

2010 2009 2010

Short-term loans payable and current portion of long term

loans payable

Secured ........................................................................ ¥ 191 ¥ 141 $2,058

Unsecured ................................................................... 260,746 398,868 2,802,517

Lease obligations due within one year .............................. 72 78 781

Unsecured zero coupon convertible bonds in yen due

2010................................................................................. —29,605 —

¥261,010 ¥428,693 $2,805,356

Long-term debt as of March 31, 2010 and 2009 consisted of the following:

Millions of yen

Thousands of

U.S. dollars

2010 2009 2010

Long-term loans payable maturing through 2016

Secured ........................................................................ ¥ 1 ¥ 42 $ 16

Unsecured ................................................................... 136,102 102,715 1,462,838

Lease obligations due more than one year ....................... 66 96 719

Other interest-bearing debts (Long-term guarantee deposited)

9,973 9,652 107,193

Unsecured zero coupon convertible bonds with 130% call

option in yen due 2013 ..................................................... 149,975 149,975 1,611,941

¥296,119 ¥262,480 $3,182,709

Consolidated Financial Statements