Suzuki 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

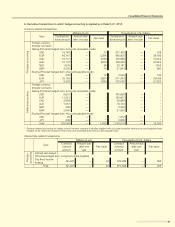

NOTE 4:FinancialInstruments

(a)Mattersforconditionsofnancialinstruments

a.Policyfornancialinstruments

As for the fund management, the Group uses short-term deposits and short-term investment securities, and as

for the fund-raising, the Group uses borrowings from nancial institutions such as banks and issuance of bonds.

The Group uses derivatives to hedge and manage the risks of interest-rates and exchange-rates uctuations, and

does not use derivatives for speculation purposes.

b.Typeofnancialinstruments,risksandriskmanagement

With respect to customers’ credit risks from operating receivables such as notes and accounts receivables-

trade, in order to mitigate the risks, the Group identies credit standing of major counterparties and manages

due date and receivable balance of each counterparty in line with our rules and regulations for credit control. The

Group hedges risks of exchange-rate uctuations from operating receivables denominated in foreign currency by

forward exchange contract in principle.

Investment securities are mainly stocks of companies with which the Group has business relationship, and as

for listed stocks, the Group quarterly identies those fair value and reports them to the Board of Directors.

Most of accounts payable-trade are due within one year.

Applications of borrowings are fund for operating capital (mainly short-term) and capital expenditures (long-term),

and the Group uses interest-rate swaps for the interest rate risks of some long-term borrowings to x interest ex-

penses.

Objectives of derivative transactions are foreign currency forward contracts to hedge the risks of exchange-

rate uctuations related to receivables denominated in foreign currencies and interest swaps to hedge the risks of

interest-rates uctuations related to borrowings. The Group executes and manages derivatives within the actual

demand in line with our rules and regulations which set out the authority to trade. In addition, in using derivatives,

the Group deals with nancial institutions which have high credit grade in order to reduce credit risks. With respect

to hedge accounting, also please see Note 2 (g).

In addition, liquidity risk related to accounts payable and borrowings, each of the Group company manages by

making a nancial plan.

c.Supplementtofairvaluesofnancialinstruments

Fair values of nancial instruments include values based on quoted prices in active markets and values as-

sessed by rational valuation techniques in case quoted prices are not available. Because the rational valuation

techniques include variable factors, the results of valuation may differ when different assumption is applied.