Suzuki 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 23

Financial Review

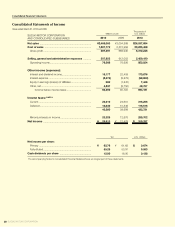

1.Operatingresults

The management environment of the Group for this scal year continues to be in a severe situation with high unemployment rates

continued in Europe and the U.S., while the global economy has not fully recovered although it is gradually recovering because of the

economic recoveries mainly in Asia and economic stimulus measures by each government. The domestic economy has recovered

to some extent with recoveries in export and production based on the overseas economic recovery and the inuences of economic

measures, but it is still in a severe situation with deationary concerns and a high unemployment rate.

Under these circumstances, consolidated sales largely declined for the two consecutive years to ¥2,469.1 billion (82.2% y-o-y)

on account of the reduced domestic and overseas sales volume and uctuations in exchange rates due to yen appreciation. As for

the consolidated prots, the reduced prots caused by a sales decline and exchange inuences were covered by the reduction of

operating expenses mainly by “internal cost reduction initiative” and favorable sales of automobiles in Asia, and prots exceeded

those of the previous scal year with ¥79.4 billion of operating income (103.2% y-o-y) and ¥28.9 billion of net income (105.4% y-o-y).

Meanwhile, non-consolidated sales declined to ¥1,286.6 billion (76.3% y-o-y). However, as for the prots, the reduced prots

caused by a sales decline and exchange inuences were covered by the vigorous reduction of various expenses and prots ex-

ceeded those of the previous scal year with ¥12.0 billion of operating income (105.1% y-o-y) and ¥7.1 billion of net income (215.6%

y-o-y).

(1)Theoperatingresultsbybusinesssegmentation

(a) Motorcycle

In the slowdown of the world economy, domestic and overseas sales were reduced, and sales of the motorcycle busi-

ness were ¥262.9 billion (57.9% y-o-y), also inuenced by exchange uctuations by yen appreciation. As for prot, the Group

posted an operating loss of ¥21.1 billion because the reduced operating expenses were unable to cover the reduced prots

by reduced sales and inuence of exchange uctuations.

(b) Automobile

In domestic market, because of the launching of fuel consumption improved cars including “SWIFT,” “MR WAGON,” and

“PALLETE,” the strengthened product and expanded sales efforts such as the launching of new “ALTO,” all the types of which

t the environmentally friendly car dissemination promotion tax system, and the implementation of governmental measures,

sales increased over the previous scal year. On the other hand, overseas sales in India increased because of favorable sales

of new model automobiles including “A-star” and “Ritz (SPLASH for the Japanese name)”, but overseas sales were below

those of the previous scal year on account of exchange uctuations by yen appreciation. As a result, sales for the automobile

business were 2,184.0 billion yen (86.5% y-o-y). Operating income increased to 90.6 billion yen (131.2% y-o-y) because the

cost reduction and the reduced operating expenses covered the reduced prots by reduced sales and inuence of exchange

uctuations.

(c) Marine and Power products, etc

Sales and operating income of marine and power products, etc. business were ¥45.4 billion (68.1% y-o-y) and ¥5.3 billion

(57.5% y-o-y), respectively, on account of global decreasing demand for outboard motors.

(d) Financial Services

Sales and operating income of nancial services business were ¥79.6 billion (101.1% y-o-y) and ¥3.8 billion (95.5% y-o-y),

respectively.

(2)Theoperatingresultsofgeographicalsegmentation

(a) Japan

Sales were ¥1,488.5 billion (81.6% y-o-y) on account of the reduced domestic and export sales. Operating income

increased to ¥34.1 billion (118.6% y-o-y) because the reduced operating expenses covered the reduced prots by reduced

sales and inuence of exchange uctuations.

(b) Europe

Sales declined to ¥423.5 billion (68.5% y-o-y) on account of reduced sales in the economic recession and the inuence of

exchange uctuations by yen appreciation. However, operating income increased by ¥1.5 billion to ¥4.6 billion because of the

reduced operating expenses.

(c) North America

Sales were ¥128.9 billion (57.1% y-o-y) on account of reduced sales in the economic deterioration and credit crunch

started by the nancial crisis and the Group posted an operating loss of ¥11.6 billion. However, operating loss decreased by

¥12.5 billion compared to the previous scal year because of the reduced operating expenses.

(d) Asia

Sales were ¥780.6 billion (103.7% y-o-y) because the increased number of units sold of automobiles by Maruti Suzuki

India Ltd. in India covered the sales decrease in ASEAN and the sales decrease inuenced by exchange uctuations of yen

appreciation. Operating income increased to ¥56.2 billion (159.0% y-o-y) by increased prots of Maruti Suzuki India Ltd.