Suzuki 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 SUZUKI MOTOR CORPORATION

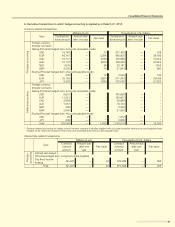

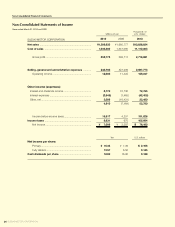

NOTE 10:Cashandcashequivalents

Cash and cash equivalents as of March 31, 2010 and 2009 consisted of:

Millions of yen

Thousands of

U.S. dollars

2010 2009 2010

Cash and deposits ........................................................ ¥147,394 ¥136,915 $1,584,203

Short-term investment securities ................................... 602,388 343,503 6,474,513

Time deposits with maturities of over three months ....... (8,305)(49,328)(89,267)

Bonds etc. with redemption period of over three months (158,020)(3,293)(1,698,418)

¥583,456 ¥427,797 $6,271,030

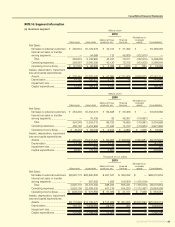

NOTE 11: Lease transactions

Operating lease transactions as of March 31, 2010 and 2009 were as follows:

As a lessee Millions of yen

Thousands of

U.S. dollars

2010 2009 2010

Future lease payments

Due within one year ................................................... ¥ 310 ¥ 401 $3,340

Thereafter................................................................... 947 1,213 10,182

¥1,258 ¥1,614 $13,523

As a lessor Millions of yen

Thousands of

U.S. dollars

2010 2009 2010

Future lease revenues

Due within one year ................................................... ¥ 6 ¥ 45 $ 65

Thereafter................................................................... 060

¥ 6 ¥ 51 $ 65

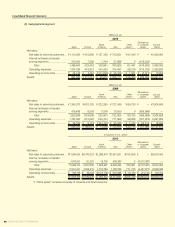

NOTE 12: Net assets

The Companies Act of Japan requires that at least 50% of the contribution of new shares be included in a company’s

common stock. The portion to be recorded as common stock is determined by resolution of the board of directors. Pro-

ceeds in excess of the common stock should be credited to “legal capital surplus”.

The Companies Act provides that an amount equivalent to 10% of cash dividends should be appropriated as a legal capi-

tal surplus or legal retained earnings until total amount of them reaches a certain limit, dened as 25% of the common stock.

The Companies Act allows both legal capital reserve and legal retained earnings to be transferred to the common stock

following the approval at a general meeting of shareholders.

The legal retained earnings of the Company and its subsidiaries are included in “retained earnings” on the consolidated

balance sheet and are not shown separately.

According to the Companies Act, the articles of incorporation allows to repurchase treasury stock and dispose of such

treasury stock by resolution of the board of directors.

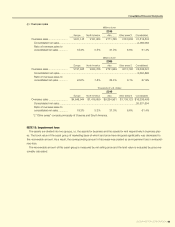

NOTE 13:Contingentliabilities

As of March 31, 2010, the Company and some of consolidated subsidiaries had the following contingent liabilities:

Millions of yen

Thousands of

U.S. dollars

Guarantee of indebtedness of afliates and others ........ ¥6,997 $75,213

Trade notes discounted ................................................. 318 3,421

¥7,316 $78,634

Consolidated Financial Statements