Suzuki 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 37

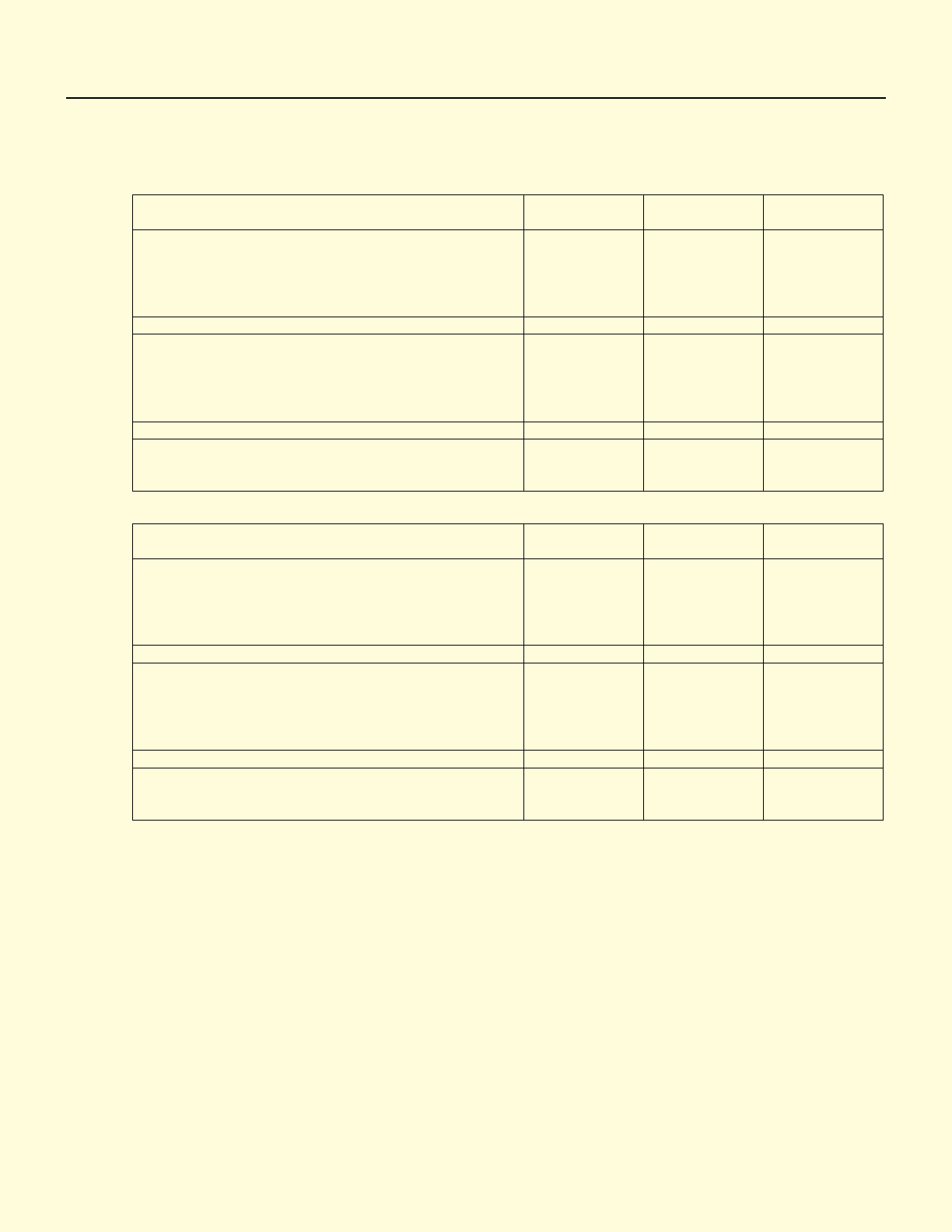

(b)Mattersforfairvaluesofthenancialinstruments

Carrying amounts in the consolidated balance sheet, fair values and unrealized gain (loss) at March 31, 2010 are as fol-

lows. Financial instruments whose fair value cannot be reliably determined are not included in the below table.

(Amount: Millions of yen)

Carrying amount Fair value Unrealized

gain (loss)

Cash and deposits 147,394 147,394 —

Notes and accounts receivables-trade 248,565 248,565 —

Short-term investment securities and Investment securities

Available-for-sale securities

Investments in subsidiaries and afliates

261,867

5,937

261,867

6,618

—

680

Total of assets 663,764 664,444 680

Accounts payable-trade 391,874 391,874 —

Short-term loans payable 221,320 221,320 —

Current portion of long-term loans payable 39,616 39,629 (13)

Bonds with subscription rights to shares 149,975 153,724 (3,749)

Long-term loans payable 136,104 136,559 (455)

Total of liabilities 938,891 943,109 (4,218)

Derivatives

Hedge accounting is applied

Hedge accounting is not applied

1,504

(373)

1,504

(373)

—

—

(Amount: Thousands of U.S. dollars)

Carrying amount Fair value Unrealized

gain (loss)

Cash and deposits 1,584,203 1,584,203 —

Notes and accounts receivables-trade 2,671,594 2,671,594 —

Short-term investment securities and Investment securities

Available-for-sale securities

Investments in subsidiaries and afliates

2,814,566

63,818

2,814,566

71,133

—

7,314

Total of assets 7,134,183 7,141,498 7,314

Accounts payable-trade 4,211,891 4,211,891 —

Short-term loans payable 2,378,771 2,378,771 —

Current portion of long-term loans payable 425,803 425,945 (141)

Bonds with subscription rights to shares 1,611,941 1,652,239 (40,298)

Long-term loans payable 1,462,855 1,467,755 (4,899)

Total of liabilities 10,091,263 10,136,603 (45,339)

Derivatives

Hedge accounting is applied

Hedge accounting is not applied

16,174

(4,016)

16,174

(4,016)

—

—

Mattersformethodsusedtomeasurefairvaluesofnancialinstruments

Assets

a. Cash and deposits and Notes and accounts receivables-trade

Because these are settled in short term and those fair values are approximately equal to the carrying amounts,

such carrying amounts are used.

b. Short-term investment securities and Investment securities

These fair values are prices of the stock exchanges. Also please see Note 2 (f).

Liabilities

a. Accounts payable-trade and Short-term loans payable

Because these are settled in short term and those fair values are approximately equal to the carrying amounts,

such carrying amounts are used.

b. Current portion of long-term loans payable and Long-term loans payable

These fair values are measured by discounting based on the estimated interest rates at which similar new loans

with same amount of principal and interest could have been borrowed.

c. Bonds with subscription rights to shares

Fair values of bonds with subscription rights to shares are measured based on the market value.

Consolidated Financial Statements