SkyWest Airlines 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

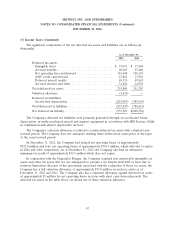

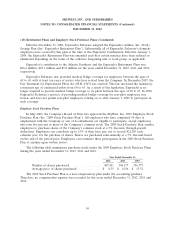

(9) Capital Transactions

Preferred Stock

The Company is authorized to issue 5,000,000 shares of preferred stock in one or more series

without shareholder approval. No shares of preferred stock are presently outstanding. The Company’s

Board of Directors is authorized, without any further action by the shareholders of the Company, to

(i) divide the preferred stock into series; (ii) designate each such series; (iii) fix and determine dividend

rights; (iv) determine the price, terms and conditions on which shares of preferred stock may be

redeemed; (v) determine the amount payable to holders of preferred stock in the event of voluntary or

involuntary liquidation; (vi) determine any sinking fund provisions; and (vii) establish any conversion

privileges.

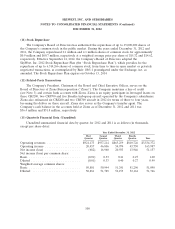

Stock Compensation

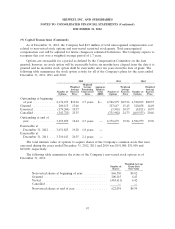

On May 4, 2010, the Company’s shareholders approved the adoption of the SkyWest Inc. 2010

Long-Term Incentive Plan, which provides for the issuance of up to 5,150,000 shares of common stock

to the Company’s directors, employees, consultants and advisors (the ‘‘2010 Incentive Plan’’). The 2010

Incentive Plan provides for awards in the form of options to acquire shares of common stock, stock

appreciation rights, restricted stock grants and performance awards. The 2010 Incentive Plan is

administered by the Compensation Committee of the Company’s Board of Directors (the

‘‘Compensation Committee’’) who is authorized to designate option grants as either incentive or

non-statutory. Incentive stock options are granted at not less than 100% of the market value of the

underlying common stock on the date of grant. Non-statutory stock options are granted at a price as

determined by the Compensation Committee.

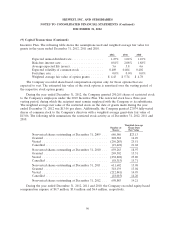

In prior years, the Company adopted three stock option plans: the Executive Stock Incentive Plan

(the ‘‘Executive Plan’’), the 2001 Allshare Stock Option Plan (the ‘‘Allshare Plan’’) and SkyWest Inc.

Long-Term Incentive Plan (the ‘‘2006 Incentive Plan’’). However, as of December 31, 2012, options to

purchase 3,031,825 shares of the Company’s common stock remained outstanding under the Executive

Plan, the Allshare Plan and the 2006 Incentive Plan. There are no additional shares of common stock

available for issuance under these plans.

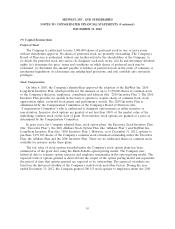

The fair value of stock options awarded under the Company’s stock option plans has been

estimated as of the grant date using the Black-Scholes option pricing model. The Company uses

historical data to estimate option exercises and employee termination in the option pricing model. The

expected term of options granted is derived from the output of the option pricing model and represents

the period of time that options granted are expected to be outstanding. The expected volatilities are

based on the historical volatility of the Company’s traded stock and other factors. During the year

ended December 31, 2012, the Company granted 200,115 stock options to employees under the 2010

95