SkyWest Airlines 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

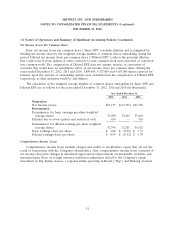

(5) Income Taxes

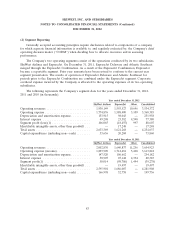

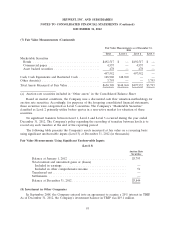

The provision for income taxes includes the following components (in thousands):

Year ended December 31,

2012 2011 2010

Current tax provision (benefit):

Federal ................................ $ — $ — $(1,600)

State .................................. 441 396 451

441 396 (1,149)

Deferred tax provision (benefit):

Federal ................................ 31,791 (21,533) 46,994

State .................................. 2,507 (1,698) 3,706

34,298 (23,231) 50,700

Provision (benefit) for income taxes ............. 34,739 (22,835) 49,551

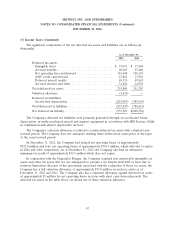

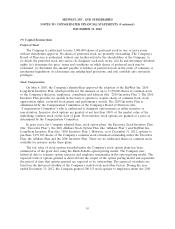

The following is a reconciliation between the statutory Federal income tax rate of 35% and the

effective rate which is derived by dividing the provision (benefit) for income taxes by income (loss)

before for income taxes (in thousands):

Year ended December 31,

2012 2011 2010

Computed ‘‘expected’’ provision (benefit) for income

taxes at the statutory rates ................... $32,983 $(14,683) $52,888

Increase (decrease) in income taxes resulting from:

Purchase accounting (gain) adjustment .......... — 1,999 (5,455)

State income tax provision (benefit), net of Federal

income tax benefit ....................... 2,220 (1,810) 3,485

Valuation allowance changes affecting the provision

for income taxes ........................ 1,614 — —

Other, net .............................. (2,078) (8,341) (1,367)

Provision (benefit) for income taxes ............. 34,739 (22,835) 49,551

For the year ended December 31, 2012, the Company recorded a $1.6 million valuation allowance

against certain deferred tax assets associated with capital losses with a limited carryforward period. The

Company anticipates the carryforward period will lapse prior to utilization of the deferred tax assets.

For the year ended December 31, 2011 in conjunction with preparing the 2010 income tax return,

the Company revised its estimate of the 2010 ExpressJet post-acquisition tax losses recorded as a

deferred tax asset as of December 31, 2010. The change in estimate resulted in a tax benefit of

$7.2 million, which is reflected in ‘‘Other, net’’ in the reconciliation above.

86