SkyWest Airlines 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

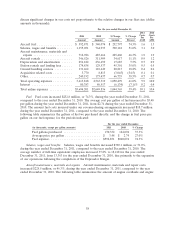

Aircraft rentals. Aircraft rentals decreased $12.9 million, or 3.7%, during the year ended

December 31, 2012, compared to the year ended December 31, 2011. The decrease was primarily due

to aircraft lease renewals at lower rates.

Depreciation and amortization. Depreciation and amortization expense decreased $2.2 million, or

0.9%, during the year ended December 31, 2012, compared to the year ended December 31, 2011. The

decrease in depreciation expense was primarily due to certain rotable assets being fully depreciated

during 2012 and a lower volume of capital expenditures.

Station rentals and landing fees. Station rentals and landing fees expense decreased $5.0 million,

or 2.9%, during the year ended December 31, 2012, compared to the year ended December 31, 2011.

The decrease in station rentals and landing fees expense was primarily due to our major partners

paying for certain station rents and landing fees directly to the applicable airports.

Ground handling service. Ground handling service expense decreased $6.3 million, or 4.8%, during

the year ended December 31, 2012, compared to the year ended December 31, 2011. The decrease in

ground handling service expense was primarily due to a reduction in outsourced ground handling

services resulting from the termination of SkyWest Airlines’ AirTran code share agreement during the

year ended December 31, 2011.

Acquisition-related costs. During the year ended December 31, 2011, we incurred $5.8 million of

direct severance, legal and advisor fees associated with Atlantic Southeast’s acquisition of ExpressJet

Delaware in November 2010. We did not incur comparable expense during the year ended

December 31, 2012.

Other operating expenses. Other expenses, primarily consisting of property taxes, hull and liability

insurance, crew simulator training and crew hotel costs, decreased $10.4 million, or 4.3%, during the

year ended December 31, 2012, compared to the year ended December 31, 2011. The decrease in other

operating expenses was primarily due to the reduction in property tax expense resulting from refunds

received during the year ended December 31, 2012, a reduction in simulator training expense and a

reduction in legal and consulting expenses.

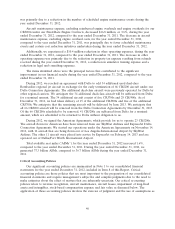

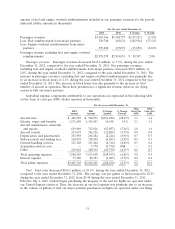

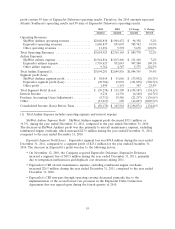

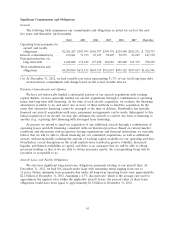

Total airline expenses. Total airline expenses (consisting of total operating and interest expenses)

decreased $248.4 million, or 6.7%, during the year ended December 31, 2012, compared to the year

ended December 31, 2011. We are reimbursed for our actual fuel costs by our major partners under

our contract flying arrangements. We record the amount of those reimbursements as revenue. Under

our Directly-Reimbursed Engine Contracts, we are reimbursed for our engine overhaul expense, which

we record as revenue. The following table summarizes the amount of fuel and engine overhaul

expenses which are included in our total airline expenses for the periods indicated (dollar amounts in

thousands).

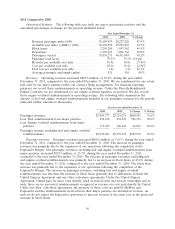

For the year ended December 31,

2012 2011 $ Change % Change

Total airline expense ......................... $3,445,765 $3,694,201 $(248,436) (6.7)%

Less: Fuel expense .......................... 426,387 592,871 (166,484) (28.1)%

Less: Engine overhauls Directly-Reimbursed Engine

Contracts ............................... 159,220 173,072 (13,852) (8.0)%

Less: CRJ200 engine overhauls reimbursed at fixed

hourly rate .............................. 55,183 77,582 (22,399) (28.9)%

Total airline expense excluding fuel and engine

overhauls and CRJ200 engine overhauls reimbursed

at fixed hourly rate ........................ $2,804,975 $2,850,676 $ (45,701) (1.6)%

53