SkyWest Airlines 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

(5) Income Taxes (Continued)

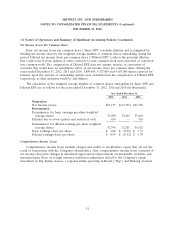

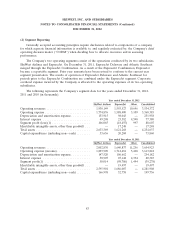

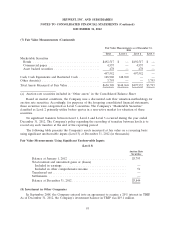

The significant components of the net deferred tax assets and liabilities are as follows (in

thousands):

As of December 31,

2012 2011

Deferred tax assets:

Intangible Asset ............................... $ 37,031 $ 37,404

Accrued benefits ............................... 40,469 35,460

Net operating loss carryforward .................... 118,448 128,134

AMT credit carryforward ......................... 15,882 15,882

Deferred aircraft credits ......................... 48,124 49,867

Accrued reserves and other ....................... 31,846 24,538

Total deferred tax assets ........................... 291,800 291,285

Valuation allowance .............................. (1,614) —

Deferred tax liabilities:

Accelerated depreciation ......................... (823,487) (789,641)

Total deferred tax liabilities ......................... (823,487) (789,641)

Net deferred tax liability ........................... (533,301 $(498,356)

The Company’s deferred tax liabilities were primarily generated through an accelerated bonus

depreciation on newly purchased aircraft and support equipment in accordance with IRS Section 168(k)

in combination with shorter depreciable tax lives.

The Company’s valuation allowance is related to certain deferred tax assets with a limited carry-

forward period. The Company does not anticipate utilizing these deferred tax assets prior to the lapse

of the carry-forward period.

At December 31, 2012, the Company had federal net operating losses of approximately

$272.0 million and state net operating losses of approximately $736.5 million, which will start to expire

in 2026 and 2016, respectively. As of December 31, 2012, the Company also had an alternative

minimum tax credit of approximately $15.9 million which does not expire.

In conjunction with the ExpressJet Merger, the Company acquired non-amortizable intangible tax

assets and other tax assets that are not anticipated to provide a tax benefit until 2025 or later due to

statutory limitations. Because of the uncertainty associated with the realization of those tax assets, the

Company has a full valuation allowance of approximately $73.0 million on such tax assets as of

December 31, 2012 and 2011. The Company also has a valuation allowance against deferred tax assets

of approximately $1 million for net operating losses in states with short carry-forward periods. The

deferred tax assets in the table above are shown net of these valuation allowance.

87