SkyWest Airlines 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

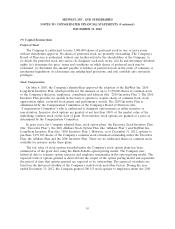

(9) Capital Transactions (Continued)

As of December 31, 2012, the Company had $4.9 million of total unrecognized compensation cost

related to non-vested stock options and non-vested restricted stock grants. Total unrecognized

compensation cost will be adjusted for future changes in estimated forfeitures. The Company expects to

recognize this cost over a weighted average period of 1.7 years.

Options are exercisable for a period as defined by the Compensation Committee on the date

granted; however, no stock option will be exercisable before six months have elapsed from the date it is

granted and no incentive stock option shall be exercisable after ten years from the date of grant. The

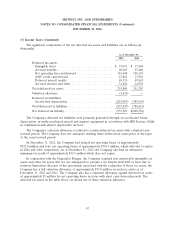

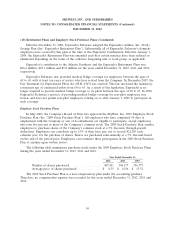

following table summarizes the stock option activity for all of the Company’s plans for the years ended

December 31, 2012, 2011 and 2010:

2012 2011 2010

Weighted

Weighted Average Aggregate Weighted Weighted

Average Remaining Intrinsic Average Average

Number of Exercise Contractual Value Number of Exercise Number of Exercise

Options Price Term ($000) Options Price Options Price

Outstanding at beginning

of year ............. 4,176,673 $19.26 2.7 years $— 4,586,979 $19.96 4,740,695 $20.37

Granted ............. 200,115 13.06 327,617 15.45 320,458 14.49

Exercised ............ (179,204) 10.57 (5,941) 10.57 (4,821) 10.57

Cancelled ............ (543,725) 25.35 (731,982) 24.73 (469,353) 20.46

Outstanding at end of

year ............... 3,653,859 18.44 2.3 years — 4,176,673 19.26 4,586,979 19.96

Exercisable at

December 31, 2012 .... 3,031,825 19.28 1.8 years —

Exercisable at

December 31, 2011 .... 3,310,143 20.35 2.1 years —

The total intrinsic value of options to acquire shares of the Company’s common stock that were

exercised during the years ended December 31, 2012, 2011 and 2010 was $191,000, $31,000 and

$19,000, respectively.

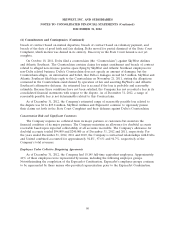

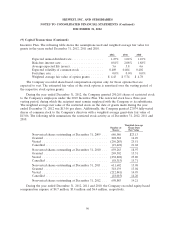

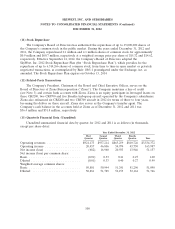

The following table summarizes the status of the Company’s non-vested stock options as of

December 31, 2012:

Weighted-Average

Number of Grant-Date

Shares Fair Value

Non-vested shares at beginning of year .............. 866,530 $4.82

Granted .................................... 200,115 4.43

Vested ..................................... (444,611) 4.42

Cancelled ................................... — —

Non-vested shares at end of year .................. 622,034 $4.99

97