SkyWest Airlines 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

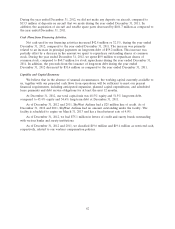

Significant Commitments and Obligations

General

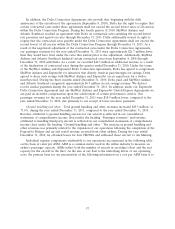

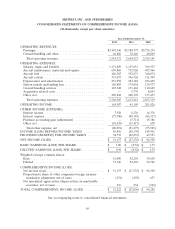

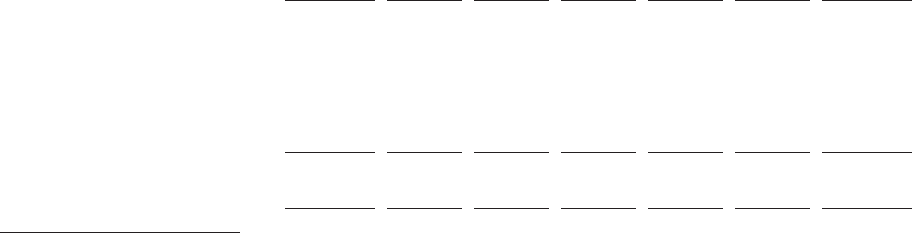

The following table summarizes our commitments and obligations as noted for each of the next

five years and thereafter (in thousands):

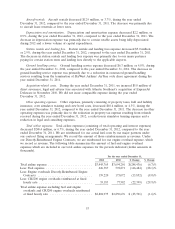

Total 2013 2014 2015 2016 2017 Thereafter

Operating lease payments for

aircraft and facility

obligations ............. $2,201,187 $387,999 $360,797 $309,378 $239,989 $182,291 $ 720,733

Interest commitments(A) .... 436,841 71,739 65,147 58,205 50,953 43,627 147,170

Principal maturities on

long-term debt .......... 1,642,022 171,454 177,390 184,510 188,240 161,735 758,693

Total commitments and

obligations ............. $4,280,050 $631,192 $603,334 $552,093 $479,182 $387,653 $1,626,596

(A) At December 31, 2012, we had variable rate notes representing 31.7% of our total long-term debt.

Actual interest commitments will change based on the actual variable interest.

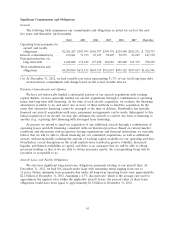

Purchase Commitments and Options

We have not historically funded a substantial portion of our aircraft acquisitions with working

capital. Rather, we have generally funded our aircraft acquisitions through a combination of operating

leases and long-term debt financing. At the time of each aircraft acquisition, we evaluate the financing

alternatives available to us, and select one or more of these methods to fund the acquisition. In the

event that alternative financing cannot be arranged at the time of delivery, Bombardier has typically

financed our aircraft acquisitions until more permanent arrangements can be made. Subsequent to this

initial acquisition of an aircraft, we may also refinance the aircraft or convert one form of financing to

another (e.g., replacing debt financing with leveraged lease financing).

At present, we intend to fund our acquisition of any additional aircraft through a combination of

operating leases and debt financing, consistent with our historical practices. Based on current market

conditions and discussions with prospective leasing organizations and financial institutions, we currently

believe that we will be able to obtain financing for our committed acquisitions, as well as additional

aircraft, without materially reducing the amount of working capital available for our operating activities.

Nonetheless, recent disruptions in the credit markets have resulted in greater volatility, decreased

liquidity and limited availability of capital, and there is no assurance that we will be able to obtain

necessary funding or that, if we are able to obtain necessary capital, the corresponding terms will be

favorable or acceptable to us.

Aircraft Lease and Facility Obligations

We also have significant long-term lease obligations, primarily relating to our aircraft fleet. At

December 31, 2012, we had 568 aircraft under lease with remaining terms ranging from one to

13 years. Future minimum lease payments due under all long-term operating leases were approximately

$2.2 billion at December 31, 2012. Assuming a 4.7% discount rate, which is the average rate used to

approximate the implicit rates within the applicable aircraft leases, the present value of these lease

obligations would have been equal to approximately $1.8 billion at December 31, 2012.

63