SkyWest Airlines 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2012

(8) Investment in Other Companies (Continued)

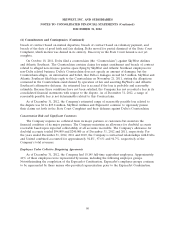

On July 12, 2012, the Company sold its interest in TRIP for a price of $42 million. The purchase

price is scheduled to be paid in three installments over a two-year period and may be accelerated upon

the occurrence of certain conditions identified in the purchase agreement. As part of the sale

transaction, the Company also received an option to acquire 15.38% of the ownership in Trip

Investimentos Ltda., the purchaser of the Company’s TRIP shares (‘‘Trip Investimentos’’). The

Company has also recorded the fair value of the option. The option has an initial exercise price per

share equal to the price paid by Trip Investimentos to acquire the TRIP shares from the Company. The

exercise price escalates annually at a specified rate and the Company can exercise the option, at its

discretion, between the second and fourth anniversaries of the Company’s receipt of the final required

installment payments from Trip Investimentos. Under the terms of the agreement, Trip Investimentos

cannot transfer the TRIP shares until the three installment payments have been made. The restriction

on Trip Investimentos’ ability to transfer the TRIP shares prevents the transaction from being

recognized as a sale. As a result, the Company will account for the transaction as a sale once all three

installment payments have been made. The Company has no continuing involvement with the TRIP

shares. As of December 31, 2012, the Company had received the first installment payment of

$8.1 million. This payment was recorded as an ‘‘Other Long-Term Liability’’ on the Company’s

consolidated balance sheet. The second installment payment is due July 12, 2013, for an amount of

$16.8 million. The third installment payment is due July 12, 2014 for an amount of $16.8 million. The

future installment payments and the option to purchase 15.38% of Trip Investimentos represent

variable interests in TRIP Investimentos, which is a variable interest entity. The Company has no equity

interest and no control over Trip Investimentos, and therefore the Company does not consolidate Trip

Investimentos.

On September 29, 2010, the Company invested $7 million for a 30% ownership interest in Air

Mekong. During 2011, the Company invested an additional $3 million in Air Mekong. As of

December 31, 2012, the Company’s investment balance in Air Mekong was $1.7 million.

The Company’s investments in TRIP and Air Mekong have been recorded as ‘‘Other Assets’’ on

the Company’s consolidated balance sheet. The Company’s ownership interest in Air Mekong

decreased to 17% as a result of additional financing received by Air Mekong. As a result, for purposes

of generally accepted accounting principles, the Company no longer has significant influence over the

operations of Air Mekong. Beginning October 1, 2012, the Company ceased to account for its

investment in Air Mekong under the equity method and, subsequent to that date, has accounted for its

investment in Air Mekong under the cost method. The Company’s portion of the losses incurred by

TRIP and Air Mekong for the year ended December 31, 2012 and 2011 was $10.2 million (pre-tax),

and $13.3 million (pre-tax), respectively. In connection with the sale of its investment in TRIP on

July 12, 2012, the Company relinquished its board seat and voting rights and for purposes of generally

accepted accounting principles, no longer has significant influence over the operations of TRIP. As a

result, the Company ceased to account for its investment in TRIP under the equity method beginning

on July 12, 2012 and, subsequent to that date, has accounted for its investment in TRIP under the cost

method.

94