SkyWest Airlines 2012 Annual Report Download - page 58

Download and view the complete annual report

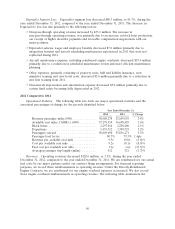

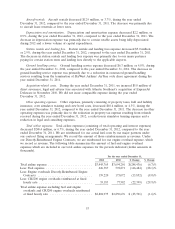

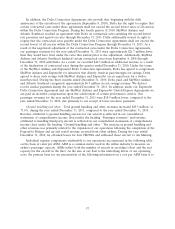

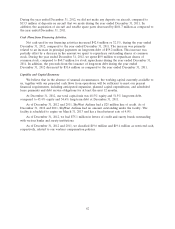

Please find page 58 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Excluding fuel and engine overhaul costs and CRJ200 engine overhauls reimbursed at fixed hourly

rates, our total airline expenses decreased $45.7 million, or 1.6%, during the year ended December 31,

2012, compared to the year ended December 31, 2011. The percentage decrease in total airline

expenses, excluding fuel and engine overhauls, was different than the percentage increase in passenger

revenues, excluding fuel and engine overhaul reimbursements from major partners, due primarily to the

factors described above.

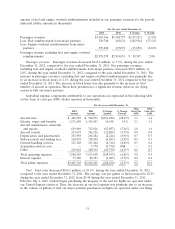

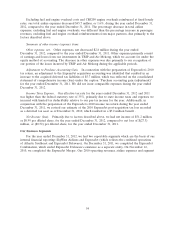

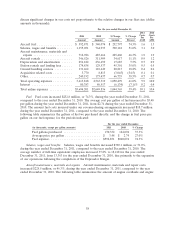

Summary of other income (expense) items:

Other expenses, net. Other expenses, net decreased $2.8 million during the year ended

December 31, 2012, compared to the year ended December 31, 2011. Other expenses primarily consist

of earnings and losses from our investments in TRIP and Air Mekong, which we account for under the

equity method of accounting. The decrease in other expenses was due primarily to our recognition of

our portion of the losses incurred by TRIP and Air Mekong during the applicable periods.

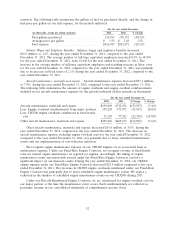

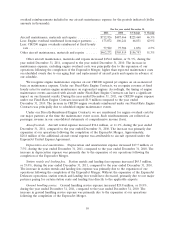

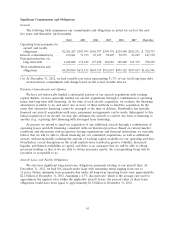

Adjustment to Purchase Accounting Gain. In connection with the preparation of ExpressJet’s 2010

tax return, an adjustment to the ExpressJet acquisition accounting was identified that resulted in an

increase to the acquired deferred tax liabilities of $5.7 million, which was reflected on the consolidated

statement of comprehensive income (loss) under the caption ‘‘Purchase accounting gain (adjustment)’’

for the year ended December 31, 2011. We did not incur comparable expenses during the year ended

December 31, 2012.

Income Taxes Expense. Our effective tax rate for the years ended December 31, 2012 and 2011

was higher than the federal statutory rate of 35%, primarily due to state income taxes and expenses we

incurred with limited tax deductibility relative to our pre-tax income for the year. Additionally, in

conjunction with the preparation of the ExpressJet’s 2010 income tax return during the year ended

December 31, 2011, we revised our estimate of the 2010 ExpressJet post-acquisition tax loss recorded

as a deferred tax asset as of December 31, 2010, which resulted in a $7.2 million benefit .

Net Income (loss). Primarily due to factors described above, we had net income of $51.2 million,

or $0.99 per diluted share, for the year ended December 31, 2012, compared to net loss of $(27.3)

million, or ($0.52) per diluted share, for the year ended December 31, 2011.

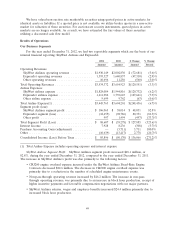

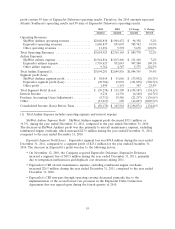

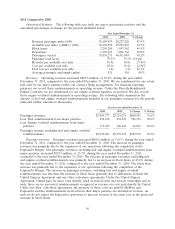

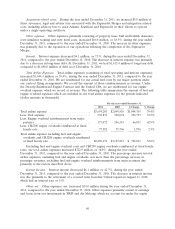

Our Business Segments

For the year ended December 31, 2012, we had two reportable segments which are the basis of our

internal financial reporting: SkyWest Airlines and ExpressJet (which reflects the combined operations

of Atlantic Southeast and ExpressJet Delaware). On December 31, 2011, we completed the ExpressJet

Combination, which ended ExpressJet Delaware’s existence as a separate entity. On November 12,

2010, we completed the ExpressJet Merger. Our 2010 operating revenues, airline expenses and segment

54