SkyWest Airlines 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

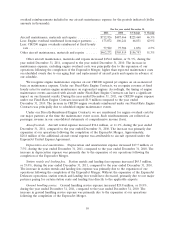

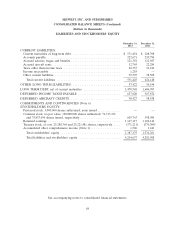

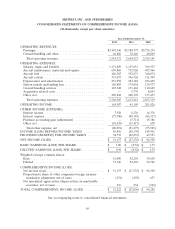

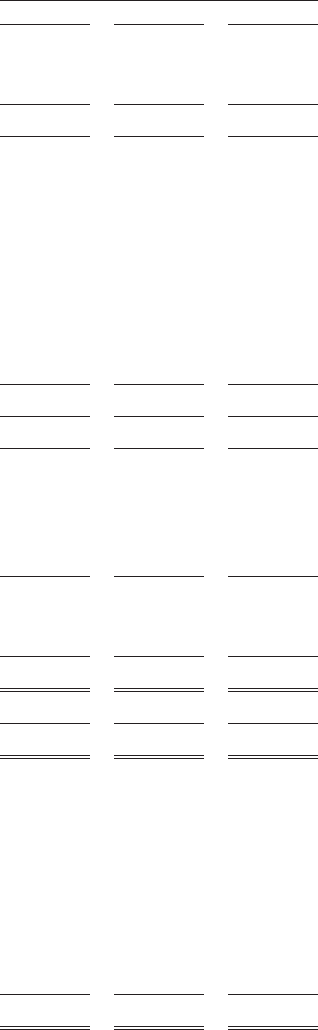

SKYWEST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands, except per share amounts)

Year Ended December 31,

2012 2011 2010

OPERATING REVENUES:

Passenger ....................................... $3,467,546 $3,584,777 $2,724,276

Ground handling and other .......................... 66,826 70,146 40,869

Total operating revenues .......................... 3,534,372 3,654,923 2,765,145

OPERATING EXPENSES:

Salaries, wages and benefits ......................... 1,171,689 1,155,051 764,933

Aircraft maintenance, materials and repairs .............. 659,869 712,926 487,466

Aircraft fuel ..................................... 426,387 592,871 340,074

Aircraft rentals ................................... 333,637 346,526 311,909

Depreciation and amortization ....................... 251,958 254,182 236,499

Station rentals and landing fees ....................... 169,855 174,838 129,537

Ground handling services ........................... 125,148 131,462 110,649

Acquisition related costs ............................ — 5,770 8,815

Other, net ...................................... 229,842 240,192 173,437

Total operating expenses .......................... 3,368,385 3,613,818 2,563,319

OPERATING INCOME ............................. 165,987 41,105 201,826

OTHER INCOME (EXPENSE):

Interest income .................................. 7,928 8,236 14,376

Interest expense .................................. (77,380) (80,383) (86,517)

Purchase accounting gain (adjustment) ................. — (5,711) 15,586

Other, net ...................................... (10,639) (13,417) 630

Total other expense, net .......................... (80,091) (91,275) (55,925)

INCOME (LOSS) BEFORE INCOME TAXES ............ 85,896 (50,170) 145,901

PROVISION (BENEFIT) FOR INCOME TAXES .......... 34,739 (22,835) 49,551

NET INCOME (LOSS) .............................. $ 51,157 $ (27,335) $ 96,350

BASIC EARNINGS (LOSS) PER SHARE ................ $ 1.00 $ (0.52) $ 1.73

DILUTED EARNINGS (LOSS) PER SHARE ............. $ 0.99 $ (0.52) $ 1.70

Weighted average common shares:

Basic .......................................... 51,090 52,201 55,610

Diluted ........................................ 51,746 52,201 56,526

COMPREHENSIVE INCOME (LOSS):

Net income (loss) ................................. $ 51,157 $ (27,335) $ 96,350

Proportionate share of other companies foreign currency

translation adjustment, net of taxes .................. (251) (295) 637

Net unrealized appreciation (depreciation) on marketable

securities, net of taxes ............................ 316 534 (745)

TOTAL COMPREHENSIVE INCOME (LOSS) ............ $ 51,222 $ (27,096) $ 96,242

See accompanying notes to consolidated financial statements.

69