SkyWest Airlines 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pursuant to which SkyWest Airlines currently operates as American Eagle on designated routes, and is

paid primarily on a fee-per-completed block hour and departure basis, plus a fixed margin per aircraft

each month and an incentive or penalty based on performance incentives.

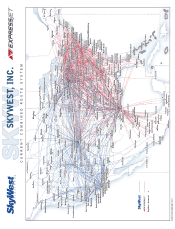

ExpressJet

ExpressJet provides regional jet service principally in the United States, primarily from airports

located in Atlanta, Cleveland, Chicago (O’Hare), Denver, Houston, Detroit, Memphis, Newark,

Minneapolis and Washington Dulles. ExpressJet offered more than 2,125 daily scheduled departures as

of December 31, 2012, of which approximately 750 were Delta Connection flights and 1,375 were

United Express flights. As of December 31, 2012, the ExpressJet fleet consisted of 18 CRJ900s (all of

which were flown for Delta), 41 CRJ700s (all of which were flown for Delta), 107 CRJ200s (93 of

which were flown for Delta and 14 of which were flown for United), 242 ERJ145s, (all of which were

flown for United) and seven ERJ135s(all of which were flown for United).

ExpressJet currently conducts Delta Connection operations pursuant to the terms of a Second

Amended and Restated Delta Connection Agreement initially executed between Delta and Atlantic

Southeast and to which ExpressJet is now a party (the ‘‘ExpressJet Delta Connection Agreement’’).

Under the ExpressJet Delta Connection Agreement, ExpressJet is paid primarily on a

fee-per-completed block hour and departure basis, plus, if ExpressJet completes a certain minimum

percentage of its Delta Connection flights, a specified margin on such costs. Additionally, the

ExpressJet Delta Connection Agreement provides for incentive compensation upon satisfaction of

certain performance goals. ExpressJet’s United code-share operations are conducted under a Capacity

Purchase Agreement initially executed by ExpressJet and Continental Airlines, Inc. (‘‘Continental’’) and

to which United became a party through its merger with Continental (the ‘‘United CPA’’) and two

United Express Agreements between ExpressJet and United (collectively, the ‘‘ExpressJet United

Express Agreements’’). Under the ExpressJet United Express Agreements and the United CPA

ExpressJet is paid by United, primarily on a fee-per-completed block hour and departure basis, plus a

margin based on performance incentives. During 2012, ExpressJet entered into a code-share agreement

with American, pursuant to which ExpressJet is paid primarily on a fee-per-completed block hour and

departure basis, plus a fixed margin per aircraft each month and an incentive or penalty based on

performance incentives. ExpressJet is scheduled to begin operations with American during February

2013.

Competition and Economic Conditions

The airline industry is highly competitive. SkyWest Airlines and ExpressJet compete principally

with other code-sharing regional airlines, but also with regional airlines operating without code-share

agreements, as well as low-cost carriers and major airlines. The combined operations of SkyWest

Airlines and ExpressJet extend throughout most major geographic markets in the United States. Our

competition includes, therefore, nearly every other domestic regional airline, and to a certain extent,

most major and low-cost domestic carriers. The primary competitors of SkyWest Airlines and

ExpressJet among regional airlines with code-share arrangements include Air Wisconsin Airlines

Corporation (‘‘Air Wisconsin’’), American Eagle Airlines, Inc. (‘‘American Eagle’’) (owned by

American), Compass Airlines (‘‘Compass’’), Horizon Air Industries, Inc. (‘‘Horizon’’) (owned by Alaska

Air Group, Inc. , Mesa Air Group, Inc. (‘‘Mesa’’), Pinnacle Airlines Corp. (‘‘Pinnacle’’), Republic

Airways Holdings Inc. (‘‘Republic’’), Trans State Airlines, Inc. (‘‘Trans State’’) and PSA Airlines, Inc.

(‘‘PSA’’) (owned by US Airways). Major airlines award contract flying to these regional airlines based

primarily upon, the following criteria: low cost, financial resources, overall customer service levels

relating to on-time arrival and departure statistics, cancellation of flights, baggage handling

performance and the overall image of the regional airline as a whole. The principal competitive factors

5