SkyWest Airlines 2003 Annual Report Download - page 50

Download and view the complete annual report

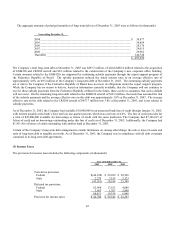

Please find page 50 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.beginning September 11, 2001, and ending December 31, 2001, resulting from the September 11, 2001, terrorist attacks on the

United States. The Company has received approximately $12.6 million under the Act to partially compensate for losses directly

resulting from the September 11, 2001 terrorist attacks as of December 31, 2002. During the years ended December 31, 2002 and

2001, the Company recognized approximately $1.4 million and $8.2 million, respectively, as a contra expense in the

accompanying consolidated statements of income under the Act.

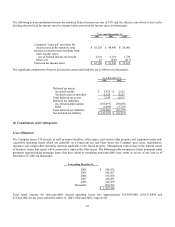

(8) Related-Party Transactions

During the year ended December 31, 2001, Delta sold its ownership interest in the Company which consisted of approximately

6.2 million shares of common stock and represented approximately 11% of the outstanding common stock of the Company. The

Company leases various terminal facilities from Delta and Delta provides certain services to the Company, including advertising,

reservation and ground handling services. Expenses paid to Delta under these arrangements were $4,500, $75,000 and $8,924,000

during the years ended December 31, 2003, 2002 and 2001, respectively. United also provides services to the Company consisting

of reservation, passenger and ground handling services. The Company paid $14,832,000, $10,602,000 and $8,884,000 to United

for services during the years ended December 31, 2003, 2002 and 2001, respectively.

The Company’s President, Chairman and Chief Executive Officer, serves on the Board of Directors for Zion’s Bancorporation

(“Zion’s”) and the Utah State Board of Regents. The Company maintains a line of credit (see Note 2) and certain bank accounts

with Zion’s, Zion’s is an equity participant in leveraged leases on two CRJ200 and four EMB120 aircraft operated by the

Company and Zion’s provides investment administrative services to the Company for which the Company paid approximately

$188,500 during the year ended December 31, 2003. The balance in the Zion’s accounts as of December 31, 2003, was

$23,896,000.

ITEM 9. CHANGES IN AND DISAGREEMENTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

On March 31, 2003, the Company dismissed its independent auditors, KPMG LLP ("KPMG"), and, effective April 7, 2003,

selected Ernst & Young LLP (“E&Y”) to be its new independent auditors. The Company’s actions were approved by the Audit

Committee of its Board of Directors.

KPMG was appointed as the Company’s independent auditors on June 24, 2002. In connection with KPMG's review of the

Company’s consolidated financial statements as of and for the three and nine-month periods ended September 30, 2002, KPMG

identified certain adjustments to the Company’s accounting for CRJ200 engine overhaul costs and related agreements. SkyWest

and KPMG initially disagreed as to the amount of the adjustments to be recorded in prior fiscal periods. Following discussions

between the Company and KPMG, which discussions involved the Company’s Board of Directors and its Audit and Finance

Committee, those disagreements were ultimately resolved through a re-audit and restatement of the Company’s consolidated

financial statements as of and for the year ended December 31, 2001 and KPMG's issuance of their report with respect thereto.

Additionally, the Company restated its consolidated financial statements as of and for the interim periods ended March 31 and

June 30, 2002. There has been no subsequent disagreement between the Company and KPMG on any matter of accounting

principles or practices, financial statement disclosure, auditing scope or procedure, which disagreement, if not resolved to

KPMG's satisfaction, would have caused KPMG to make reference to the subject matter of such disagreement in connection with

its reports. The Company has authorized KPMG to respond fully to any inquiries of any successor accountant concerning the

subject matter of such disagreements. There have occurred no reportable events as defined in Item 304(a)(1)(V) of Regulation S-

K promulgated by the Securities and Exchange Commission.

The audit reports of KPMG on the Company’s consolidated financial statements for the fiscal years ended December 31, 2002

and 2001, did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit

scope or accounting principles, except as follows:

KPMG's report on the Company’s consolidated financial statements as of and for the year ended December 31, 2001,

contained a separate paragraph stating that "the Company has restated the consolidated balance sheet as of December 31,

2001, and the related consolidated statements of income, stockholders' equity and comprehensive income, and cash flows

and financial statement schedule for the year then ended, which consolidated financial statements and financial statement

schedule were previously audited by other independent auditors who have ceased operations."

47