SkyWest Airlines 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.amount deemed to be rental income during the year was $44.2 million and has been included in passenger revenue on the

Company’s statements of income.

On April 3, 2003, the Company signed a new agreement with Continental to supply Continental with regional airline feed into its

Houston hub beginning on July 1, 2003. The Company’s Continental Connection operations are currently conducted using the

Company’s EMB120s and EMB120s leased from Continental. The Continental agreement provides for payment to the Company

of a prorated portion of passenger fares, plus a minimal amount if minimal load factors aren’t experienced.

The agreements with Delta, United and Continental contain certain provisions pursuant to which the parties could terminate the

respective agreements, subject to certain rights of the other party, if certain performance criteria are not maintained. The

Company’s revenues could be impacted by a number of factors, including changes to the agreements, the annual negotiations and

the Company’s ability to earn incentive payments contemplated under the agreements.

In the event that the Company’s contractual rates have not been finalized at quarterly and or annual report dates, the Company

records revenues based on a prior period’s approved rates, adjusted to reflect management’s current estimate of the results of

these negotiations. If the contractual rates differ from those estimated by management, the Company will reflect these changes in

future condensed consolidated financial statements upon finalization of negotiations.

The Company’s results of operations included a positive pretax amount of $5.9 million, or $0.10 per diluted share, resulting from

adjustments made to reflect the Company’s actual operating results from flights under the United Express Agreement, which were

more favorable to the Company than the rates and expenses estimated by the Company prior to the execution of the United

Express Agreement.

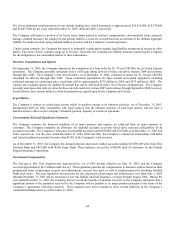

Deferred Aircraft Credits

The Company accounts for incentives provided by aircraft manufacturers as deferred credits. Credits related to leased aircraft are

amortized on a straight-line basis as a reduction to lease expense over the respective lease term. Credits related to owned aircraft

are amortized on a straight-line basis as a reduction in depreciation expense over the life of the related aircraft. The incentives are

credits that may be used to purchase spare parts and pay for training and other expenses.

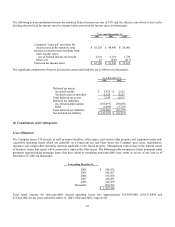

Income Taxes

The Company recognizes a liability or asset for the deferred tax consequences of all temporary differences between the tax basis

of assets and liabilities and their reported amounts in the consolidated financial statements that will result in taxable or deductible

amounts in future years when the reported amounts of the assets and liabilities are recovered or settled.

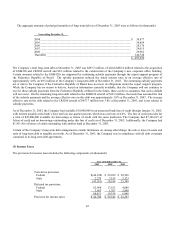

Net Income Per Common Share

Basic net income per common share (“Basic EPS”) excludes dilution and is computed by dividing net income by the weighted

average number of common shares outstanding during the period. Diluted net income per common share (“Diluted EPS”) reflects

the potential dilution that could occur if stock options or other contracts to issue common stock were exercised or converted into

common stock. The computation of Diluted EPS does not assume exercise or conversion of securities that would have an

antidilutive effect on net income per common share. During the years ended December 31, 2003 and 2002, 2,735,000 and,

2,790,000 options were excluded from the computation of Diluted EPS respectively.

38