SkyWest Airlines 2003 Annual Report Download - page 43

Download and view the complete annual report

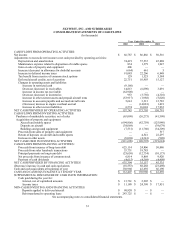

Please find page 43 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.loss includes adjustments, net of tax, to reflect unrealized appreciation (depreciation) on marketable securities. The Company

recorded net unrealized appreciation (depreciation) of $1,273,000, $168,000, and ($615,000), net of income taxes, on marketable

securities for the years ended December 31, 2003, 2002, and 2001 respectively. These adjustments have been reflected in the

accompanying consolidated statements of stockholders’ equity and comprehensive income.

Fair Value of Financial Instruments

The carrying amounts reported in the consolidated balance sheets for cash and cash equivalents, receivables and accounts payable

approximate fair values because of the immediate or short-term maturity of these financial instruments. Marketable securities are

reported at fair value in the consolidated balance sheets. The fair value of the Company’s long-term debt is estimated based on

current rates offered to the Company for similar debt and approximated $414,369,000 as of December 31, 2003, as compared to

the carrying amount of $493,650,000. The Company’s fair value of long-term debt as of December 31, 2002 was $132,603,000

as compared to the carrying amount of $137,911.000.

Statement of Financial Accounting Standards SFAS (“No. 133”), “Accounting for Derivative Instruments and Certain Hedging

Activities, SFAS No. 138, Accounting for Certain Derivative Instruments and Certain Hedging Activity, an Amendment of SFAS

133 and related interpretations require that all derivative instruments be recorded on the balance sheet at their respective fair

values.

The Company has an interest rate swap agreement to manage its exposure on the debt instrument related to the Company’s

headquarters. The Company's policies do not permit management to enter into derivative instruments for any purpose other than

cash flow hedging purposes. Accordingly, the Company does not speculate using derivative instruments. The Company assesses

interest rate cash flow risk by identifying and monitoring changes in interest rate exposures that may adversely impact expected

future cash flows and by evaluating hedging opportunities. The fair values of the Company's derivative instruments are

recognized as other current liabilities in the accompanying balance sheet. The Company adopted SFAS No. 133 and SFAS No.

138 on January 1, 2001. In accordance with the transition provisions of SFAS No. 133, the Company recorded a $900,000 and

$1,125,000 liability at December 31, 2003 and 2002 respectively, in the accompanying consolidated balance sheets. The

Company decreased interest expense by $225,000 during the year ended December 31, 2003 and increased interest expense by

$1,125,000 for the year ended December 31, 2002 in accordance with the interest swap agreement.

40