SkyWest Airlines 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Segment Reporting

The Company has adopted SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information. This statement

requires disclosures related to components of a company for which separate financial information is available that is evaluated

regularly by the Company’s chief operating decision maker in deciding how to allocate resources and in assessing performance.

Management believes that the Company has only one operating segment in accordance with SFAS No. 131 because the

Company’s business consists of scheduled airline passenger service.

New Accounting Standard:

In January 2003, the FASB issued Interpretation No. 46, or (FIN 46), Consolidation of Variable Interest Entities, which requires

the consolidation of variable interest entities. It is management’s belief that the majority of the Company’s leased aircraft is

owned and leased through trusts whose sole purpose is to purchase, finance and lease these aircraft to the Company; therefore,

they meet the criteria of a variable interest entity. However, since these are single owner trusts in which the Company does not

participate, the Company is not at risk for losses and is not considered the primary beneficiary. As a result, based on the current

rules, the Company is not required to consolidate any of these lessors or any other entities in applying FIN 46. Management

believes that the Company’s maximum exposure under these leases is the remaining lease payments, which are reflected in the

future minimum lease payments table in Note 4 to the Company’s Consolidated Financial Statements as of December 31, 2003.

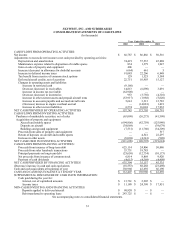

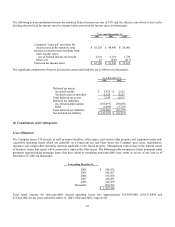

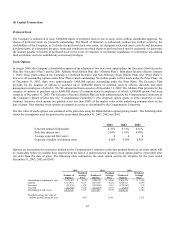

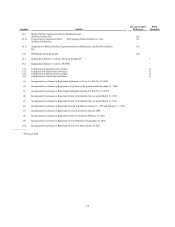

(2) Long-term Debt

Long-term debt consisted of the following as of December 31, 2003 and 2002 (in thousands):

2003 2002

Notes payable to banks, due in semi-annual installments plus

interest based on six-month LIBOR plus 1.30% to 1.375% at

December 31, 2003 through 2019, secured by aircraft $ 120,330 $ -

Notes payable to banks, due in semi-annual installments plus

interest at 6.09% through 2020, secured by aircraft 103,350

Notes payable to banks, due in semi-annual installments plus

interest based on six-month LIBOR plus 1.40% at

December 31, 2003 through 2019, secured by aircraft 85,168 -

Notes payable to banks, due in semi-annual installments plus

interest at 6.06% to 6.45% through 2018, secured by aircraft 61,206 63,722

Notes payable to banks, due in quarterly installments plus

Interest based on three-month LIBOR plus 0.75% at

December 31, 2003 through 2019, secured by aircraft 59,424 -

Notes payable to banks, due in semi-annual installments plus

interest at 3.72% to 3.86%, net of the benefits of interest

rate subsidies through the Brazilian Export financing

Program, through 2011, secured by aircraft 18,160 20,339

Note payable to bank, due in semi-annual installments plus

interest at 7.18% through 2012, secured by aircraft 14,298 15,080

Note payable to bank, due in semi-annual installments plus

interest based on six- month LIBOR plus 0.60% at

December 31, 2003 through 2016, secured by aircraft 13,876 14,482

Notes payable to bank, due in monthly installments plus

interest based on one-month LIBOR through 2012, secured by building 8,319 8,772

Notes payable to banks, due in monthly installments including

interest at 6.70% to 7.37% through 2006, secured by aircraft 7,528 11,490

Other notes payable, secured by aircraft 1,991 4,026

493,650 137,911

Less current maturities (30,877) (12,532)

$ 462,773 $ 125,379

At December 31, 2003, the three-month and six-month LIBOR rates were 1.157% and 1.219%, respectively.

41